Dark Times For WinZO

In a dramatic turn, the Enforcement Directorate (ED) yesterday arrested WinZO’s cofounders Saumya Singh Rathore and Paavan Nanda. So, how did the founders, once hailed as the gaming industry’s pioneers, go from the spotlight to the custody of the agency?

Tracing The Timeline: The arrests followed a string of ED raids and the freezing of nearly INR 505 Cr in assets tied to WinZO. The agency alleges that the company continued operating real-money gaming (RMG) platforms for foreign markets from India, even after the ban on RMG in August. The founders were questioned in Bengaluru and are now in the ED custody, facing serious charges of money laundering and fraud.

Long List Of Allegations: At the heart of the case are allegations that WinZO manipulated game outcomes by pitting users against bots, limited customer withdrawals, and failed to refund over INR 43 Cr to players post the RMG ban. The ED also allegedly found that funds from WinZO’s Indian entity were diverted to a US-based shell company, with $55 Mn (INR 489.9 Cr) parked overseas.

Besides, FIRs filed against the company cite cheating, account blocking, impersonation, and misuse of PAN cards, painting a picture of systemic misconduct.

RMG Ecosystem In A Flux: The arrests come amid a sweeping regulatory crackdown on the RMG space. Since the ban, the sector has witnessed mass layoffs and shutdowns. The ED is also probing other major players like Gameskraft and Pocket52 over allegations of rigging and blocking withdrawals.

As the industry reels from the regulatory clampdown, can WinZO and its founders emerge from the shadow of this chapter and rebuild their credibility in an ecosystem demanding transparency and accountability? Let’s find out…

From The Editor’s Desk

Meesho All Set For D-Street Debut

- The ecommerce major has filed its red herring prospectus (RHP) with SEBI for its upcoming IPO, which will comprise a fresh issue worth INR 4,250 Cr and an OFS component of 10.55 Cr shares. The issue will open on December 3.

- The OFS will see participation from both founders, Vidit Aatrey and Sanjeev Kumar, who are looking to sell up to 1.6 Cr shares each. Early backers like Elevation Capital, Peak XV Partners, Venture Highway and Y Combinator will also sell their stakes.

- On the financial front, Meesho managed to slash its net losses by 72% YoY to INR 700.7 Cr in H1 FY26, while operating revenues rose 29.4% YoY to INR 5,577.5 Cr during the period under review.

NEWME Eyes $12 Mn

- The women-focussed fast fashion brand is in advanced talks to raise INR 107 Cr in its Series B round from new and existing backers at a valuation in the range of $100 Mn (INR 893 Cr) to $120 Mn (INR 1,000 Cr).

- Founded in 2022, NEWME has built a Gen Z-centric brand with 7 Mn+ customers, 14 retail stores, and a digital-first approach that blends trend-led designs with real-time inventory and dark store-backed delivery.

- NEWME competes with both Indian players like OUTZIDR, KNOT, ZILO and global giants like H&M and Zara. The company cites its agility, digital scale, and focus on Gen Z as its USP in the growing fast fashion market.

CarTrade Calls Off CarDekho Acquisition

- After months of negotiations and due diligence, the listed auto classifieds platform and its rival have mutually decided to halt the planned acquisition, citing strategic re-evaluations.

- The proposed $1.2 Bn transaction would have been among the largest deals in India’s auto tech space. The deal was banking on uniting CarTrade’s strengths in dealer auctions, remarketing, and B2B financing with CarDekho’s deep partnerships.

- The market reaction was immediate – CarTrade shares plummeted, reflecting investor disappointment.

Aequs Gears Up For IPO

- The contract manufacturing company has filed its RHP with SEBI for its public issue, which will open on December 3 and close on December 5. The IPO will comprise a fresh issue worth INR 670 Cr and an OFS of up to 2.03 Cr shares.

- Founded in 2006, Aequs operates as a contract manufacturing company that builds and runs large, integrated facilities to produce aerospace components, toys and consumer durables.

- As per its RHP, Aequs reported a net loss of INR 16.9 Cr in H1 FY26 against an operating revenue of INR 537.1 Cr.

Swiggy Rejects Reports Of Market Share Loss

- Swiggy has disputed a media report, which claimed that its quick commerce arm Instamart had lost market share to Zepto, terming the data in the publication as ‘baseless and unreliable’.

- The controversy erupted after a media report cited an HSBC internal memo, which attributed market share claims to Redseer and Zepto. Swiggy confirmed directly with Redseer, which said that no such data or analysis was shared.

- The episode highlights how quickly unverified third-party data can shape market narratives, and Swiggy’s swift regulatory filing signals a new level of vigilance among listed companies in India’s fiercely competitive quick commerce space.

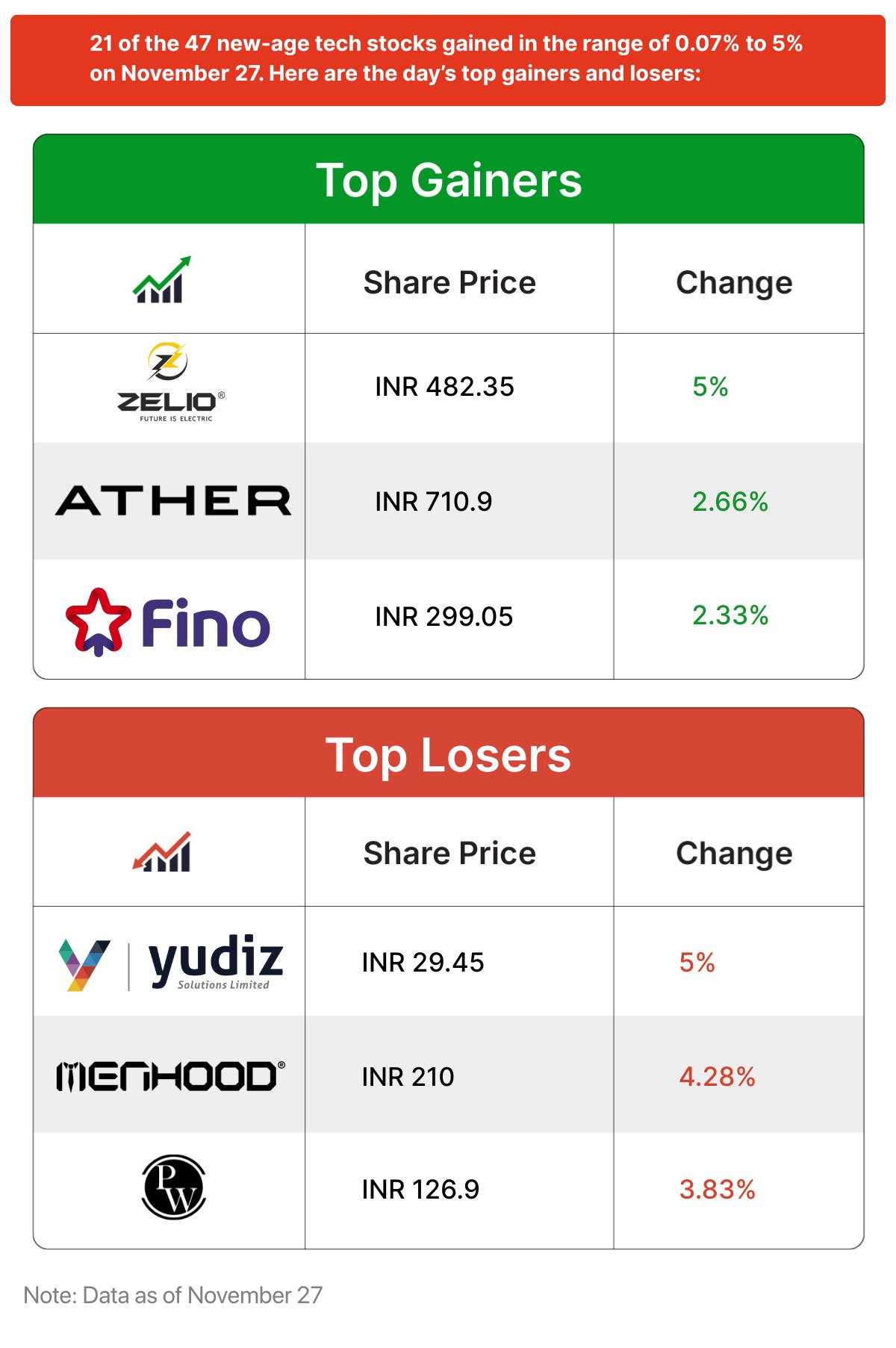

Inc42 Markets

Inc42 Startup Spotlight

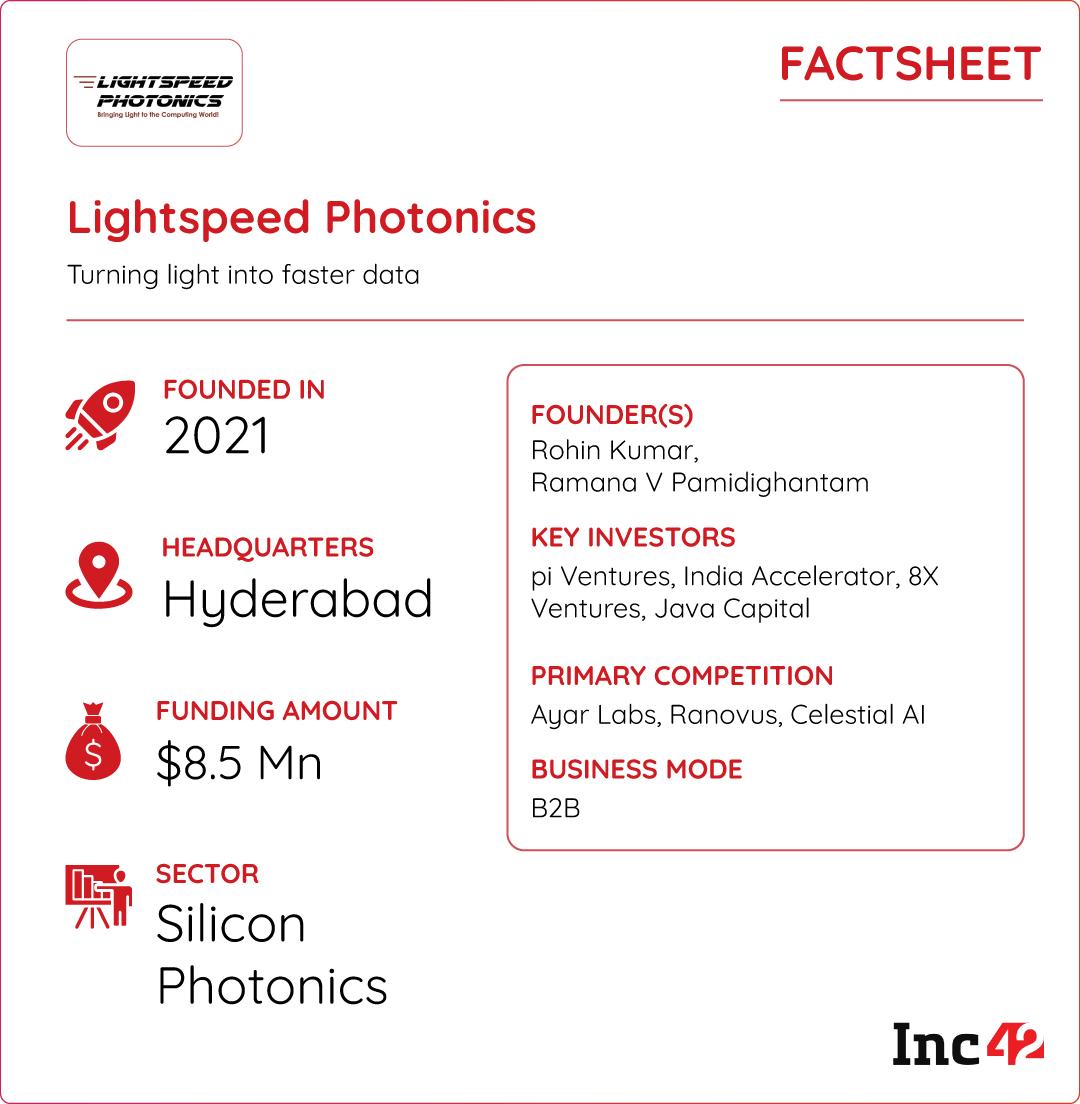

How LightSpeed Is Solving The AI Data Centre Puzzle

As AI reshapes industries, the world is facing a silent crisis – data centres, the engines powering this tech, are hitting their limits. With AI-driven workloads demanding ever-faster data processing, traditional electrical interconnects are struggling to keep up, leading to energy waste, space constraints and slower performance.

The Photonics Push: Founded in 2021, Hyderabad-based LightSpeed Photonics is tackling this bottleneck with optical interconnects that move data faster and more efficiently within data centres. Its solderable optical components fit into existing architectures, making adoption easier for OEMs and data centre builders without costly redesigns.

Scaling For Global Impact: Backed by funding from pi Ventures, LightSpeed is expanding R&D and piloting its products in upcoming data centre builds. Going forward, the company is targeting the US market, home to 40% of global data centres, while preparing to scale in India, Southeast Asia, and the Middle East.

LightSpeed is pitching its frugal and scalable approach as a potential game-changer in AI infrastructure. But can the startup’s optical interconnects be the missing piece in the global AI hardware puzzle?

Infographic Of The Day

From payments to lending, India’s digital finance giants are proving they’re ready for the scrutiny and scale of public markets.

The post WinZO’s Founders Arrested, Meesho & Aequs IPOs Next, And More appeared first on Inc42 Media.

https://ift.tt/4V9OyJp

0 Comments