Meesho’s IPO Ahead

Indian startup IPO spring is in its full bloom, and Meesho, too, is now gearing up to park at D-Street. Notably, the ecommerce major is eyeing a listing by next month, with a target valuation of $6 Bn (INR 53,700 Cr).

What’s Inside Meesho’s IPO Cart: The ecommerce major plans to raise INR 4,250 Cr via fresh issue, while existing investors and founders are looking to sell 17.5 Cr shares through OFS. The proceeds will fund the company’s technology expansion, marketing efforts, and strategic acquisitions.

Meanwhile, it has also released its FY25 numbers. Here’s a snapshot:

- Revenues rose 23% YoY to INR 9,390 Cr

- Net losses ballooned 12X YoY to INR 3,915 Cr

- Expenses shot up 22% YoY to over INR 10,000 Cr

The Moat: Meesho benefits from robust revenue growth and an asset-light model that fuels scalability. Its rapidly expanding reseller network, domination in tier II and tier III cities and reduced delivery costs in FY25, along with an in-house logistics arm Valmo, create a strong, differentiated moat. The broader Indian IPO market boom also provides an encouraging backdrop for its listing.

What Holds Meesho Back? However, what ails the company is its steep net losses and heavy reliance on cash-on-delivery orders, which make up over 75% of shipments. This results in delivery inefficiencies, higher costs due to failed orders, and cash handling risks. The company also confronts intense competition from deep-pocketed rivals like Amazon and Walmart-backed Flipkart, which could pressure Meesho’s margins.

With growing competition and market dynamics shifting fast to quick commerce, can Meesho’s $6 Bn valuation stand the test of public market scrutiny? Let’s find out…

From The Editor’s Desk

India’s Startup IPO Spring

India’s Startup IPO Spring

- Indian startups have raised INR 33,000 Cr via 15 IPOs so far in 2025. While the surge in such listings has fuelled comparisons to the dot-com bubble, senior Axis Bank executive Sanjiv Bhatia calls the growing startup IPOs “a healthy trend”.

- In Bhatia’s words, multiple converging dynamics explain India’s startup IPO explosion – massive inflows from SIPs, VCs hitting exit deadlines and domestic capital cushioning against market crashes.

- SEBI’s disclosure requirements are also ensuring transparency, while portfolio managers are acting as intelligent gatekeepers for retail capital flowing through mutual funds and pension schemes.

Inside Furlenco’s Revival Story

Inside Furlenco’s Revival Story

- After over a decade of heavy losses, mounting debt, and operational struggles, the furniture rental startup achieved its first net profit of INR 3.1 Cr in FY25. Now, it has set its eyes on an IPO in FY27.

- The company achieved this turnaround on the back of growing revenues, strategic operational redesigns, leveraging AI, in-house manufacturing, and expanding warehousing.

- A key lifeline was Sheela Foam’s INR 300 Cr investment in Furlenco in 2023, followed by another INR 107 Cr infusion a year later. This enabled the rental startup to expand to 28 cities and grow its user base from 60,000 to 1.5 Lakh.

Another Blow To Byju Raveendran

Another Blow To Byju Raveendran

- A US court has issued a default judgment, directing the founder of BYJU’S to pay $1.07 Bn. The order pertained to alleged misappropriation of $533 Mn from troubled edtech’s US subsidiary and another $540.6 Mn linked to hedge fund interests.

- The court cited repeated non-compliance with discovery orders, missed deadlines, and failure to provide documents or appear, leading to the ruling without trial.

- Raveendran refuted the judgment, claiming it was premature, based on misleading claims by lender Glas Trust, and vowed to appeal with evidence. He also threatened $2.5 Bn in US federal claims.

Weekly Startup Funding Rebounds

Weekly Startup Funding Rebounds

- Indian startups cumulatively raised $171.4 Mn across 20 deals last week, a marginal 5% uptick from the $162.9 Mn in the preceding week. Yubi and AgroStar topped the charts and secured $46.4 Mn and $30 Mn, respectively.

- Fintech and ecommerce continued to be investors’ favourite sectors. Inflection Point Ventures (IPV) and Titan Capital were the most active investors last week.

- The week reflected a cautiously improving funding environment amid sectoral churn, regulatory updates and strategic moves across venture debt, spacetech and SaaS.

Agnikul Bags Big Bucks

Agnikul Bags Big Bucks

- The space tech startup has raised $17 Mn from Advenza Global, Artha Select Fund, HDFC and a few other family offices to build a new facility and expand production. The round pushed Agnikul’s valuation to $500 Mn.

- Founded in 2017, Agnikul develops small-lift launch vehicles, powered by its 3D-printed semi-cryogenic rocket engine. It has raised more than $58 Mn so far from marquee names like Celesta Capital and Rocketship.vc.

- Agnikul’s fundraising reflects growing investor confidence in India’s spacetech sector, which is projected to become a $77 Bn opportunity by 2030.

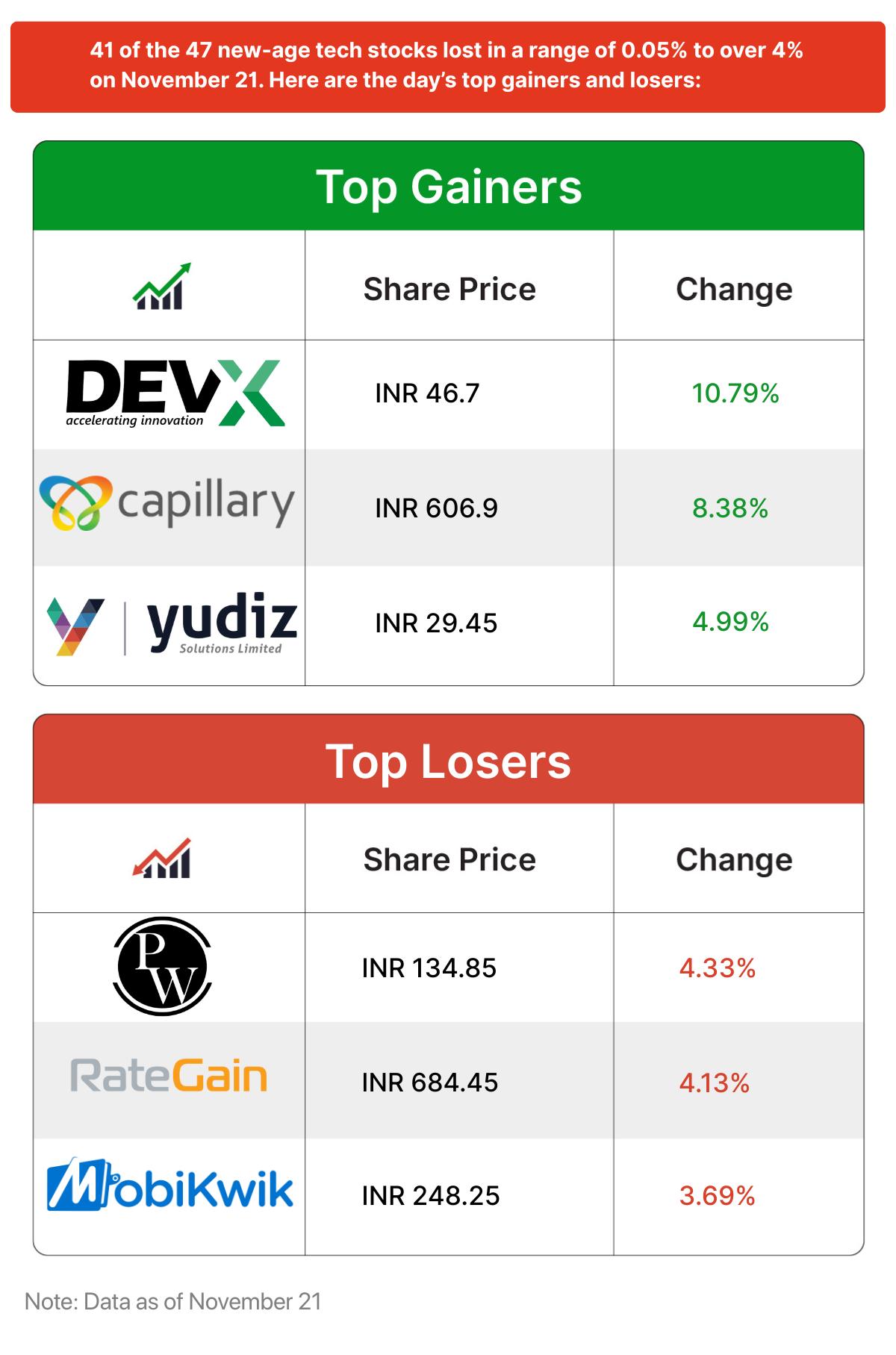

Inc42 Markets

Inc42 Startup Spotlight

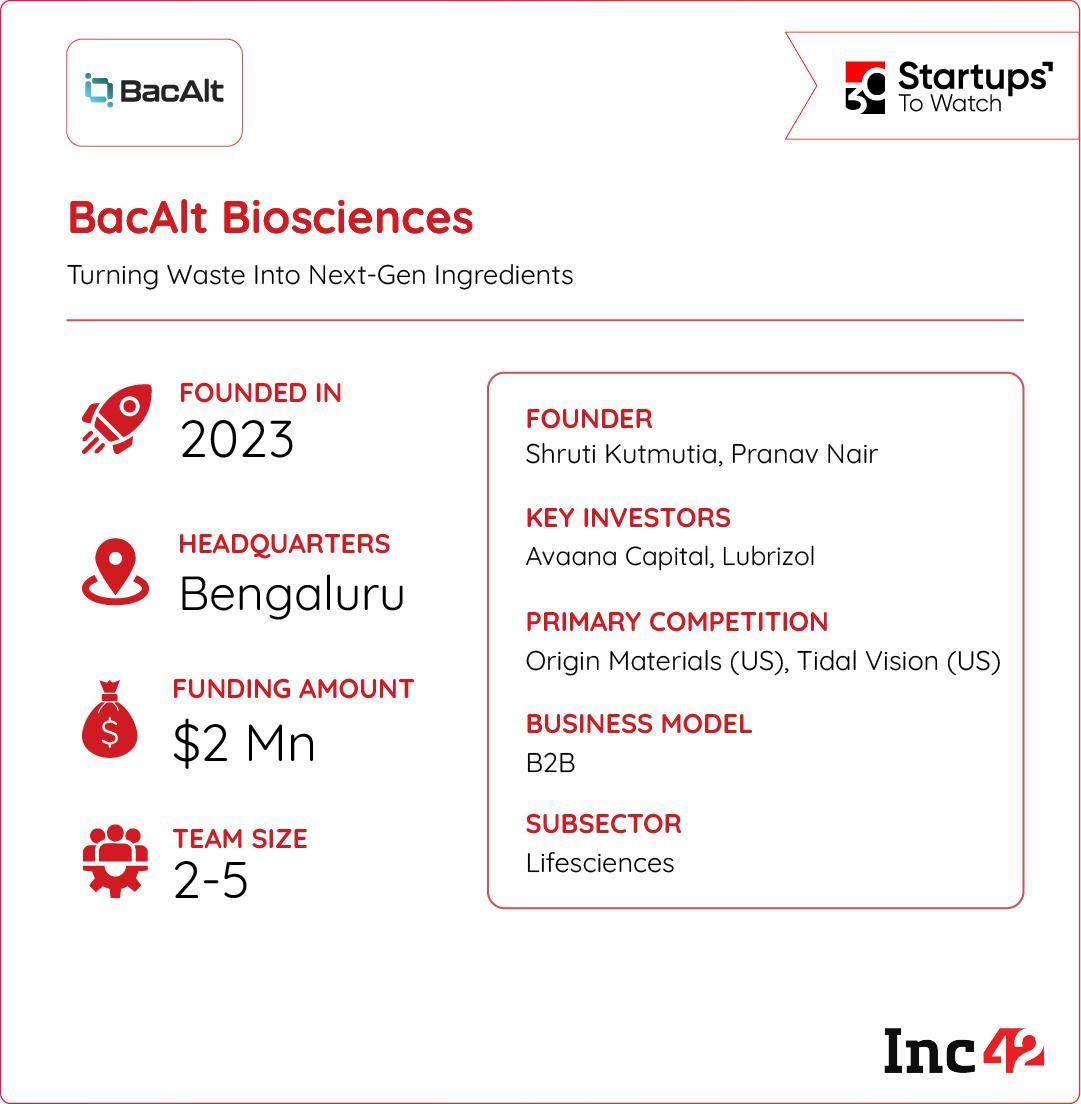

How BacAlt Is Turning Farm Waste Into Polymers?

Synthetic polymers are used in everything, from shampoos to packaging. Yet, their non-biodegradable nature and dependence on fossil fuels pose sustainability challenges. Bengaluru‑based startup, BacAlt Biosciences, believes the solution lies in nature, not a factory.

Turning Waste Into Gold: Founded in 2023, BacAlt’s proprietary non‑sterile fermentation process transforms post‑harvest agricultural residues into high‑performance bacterial polymers. These polymers act as natural thickeners, stabilisers, and moisture‑binding agents, which can substitute petrochemical‑derived materials in everyday products.

Bio‑Based Alternate: BacAlt is targeting industries that consume millions of tonnes of synthetic polymers annually — cosmetics, home care, agriculture, and pharmaceuticals. Its bio‑based polymers not only promise biodegradability but also deliver technical performance comparable to their synthetic counterparts.

Riding The Growing Demand: Going forward, BacAlt Biosciences is looking to ride the rising demand wave with its cleantech moat and recycle more than 60,000 kg of farm waste annually. It is looking to tap into India’s sustainable biopolymers market, which is projected to grow to $844.2 Mn by 2032.

Backed by its sustainability proposition, can BacAlt Biosciences help industries save energy and cut down on waste?

Infographic Of The Day

From dosa batter to a 35+ SKU powerhouse — iD Fresh is levelling up with bold targets and IPO ambitions. Here’s a quick look…

The post Meesho’s IPO, Furlenco’s Revival & More appeared first on Inc42 Media.

https://ift.tt/t5nzYlW

0 Comments