VinFast Revs Up; Should Indian EV Makers Worry?

A new rival is now on the prowl in the homegrown electric two-wheeler (E2W) space. Vietnamese EV major VinFast has confirmed that it will launch its first E2Ws in India in 2026. Will this new player change the electric two-wheeler game, or will it prove to be just a passing breeze?

Disruption On Wheels: Drawing from its deep expertise and popular two-wheeler models from its home market, Vinfast is currently studying local consumer needs and is lining up its dealer network. Alongside, it aims to anchor its India play in mobility as well, launching EV ride-hailing and is in talks with multiple state governments to roll out electric bus services.

The $2 Bn Blueprint: VinFast is not just introducing a new scooter, it is strategically entrenching itself in India’s EV segment. The company’s $2 Bn (INR 16,000 Cr) commitment for its Tamil Nadu plant hints at establishing deep roots in India and developing an export springboard. This gives the Vietnamese company a cost and supply chain advantage over its import-focussed rivals like Tesla.

Incumbents Fasten Seatbelts: VinFast’s entry spells trouble for local players and is expected to further intensify price wars and product innovation. The problem is especially acute for Ola Electric, which has seen a dramatic fall in market share. November figures show the Bhavish Aggarwal-led company’s registrations halved to 8,400 units, the lowest all year, amid after-sales issues and growing competition from Ather and legacy giants.

So, just as India’s EV market prepares for a consolidation phase, will VinFast’s vertically integrated mobility strategy help it disrupt the E2W market? Let’s find out…

From The Editor’s Desk

It’s Raining ESOPs

It’s Raining ESOPs

- A total of 12 Indian startups have undertaken ESOP buybacks in 2025 so far, helping over 9,200 employees unlock wealth worth more than INR 1,409 Cr. However, overall buyback value dipped slightly compared to 2024, and fewer startups participated.

- These buybacks were strategic moves to reward long-serving employees, attract talent, and build a positive financial image.Notable examples include Flipkart’s INR 430 Cr and PhonePe’s INR 700–800 Cr buyback.

- New-age tech companies like Decentro, InsuranceDekho, Rapido, and SpeakX also rolled out maiden or second ESOP buyback programmes, enabling employees to realise 3X to 10X returns on their original strike prices.

𖣘 Atomberg’s $200 Mn IPO

- The Temasek-backed home appliances startup is gearing up for its INR 1,790 Cr IPO, with bankers and advisors expected to be appointed soon. The public issue will likely be a mix of fresh shares and an offer for sale.

- Founded in 2012, Atomberg started with B2B sales of energy-efficient BLDC fans before entering the consumer market in 2016. The company now sells fans, mixer grinders, water purifiers, and other small appliances.

- Atomberg’s move comes amid a wave of new-age tech IPOs, with 15 new-age tech companies going public this year and major listings like Meesho, Aequs, and Wakefit scheduled for December.

Finfactor Bags $15 Mn

Finfactor Bags $15 Mn

- NBFC aggregator Finvu’s parent has raised fresh capital in its Series A round led by WestBridge Capital to scale its product suite, expand its teams, and deepen its presence in lending and wealth management spaces.

- Founded in 2019, Finvu enables secure, consent-based sharing of financial data. It claims to serve more than 150 BFSI companies, including HDFC Bank and Axis Bank, and 50 Mn end consumers.

- With India’s fintech market expected to reach $133 Bn by 2030, the fundraise reflects the broader trend of startups leveraging the account aggregator framework to unlock value in the open-finance ecosystem.

Govt’s New Lock For Smartphones

Govt’s New Lock For Smartphones

- The telecom ministry has directed all major smartphone makers to preload the Sanchar Saathi app on all new devices sold in India. The app aims to combat cybercrimes by blocking stolen devices, tracking lost phones and spotting fake IMEI numbers.

- Separately, DoT has also directed messaging platforms to enforce mandatory SIM binding, ensuring users can only access services on the device with the SIM used during registration. Platforms have 90 days to implement these changes.

- The directions are part of a broader government strategy to tackle the sharp rise in cyber incidents as Indians losing INR 22,845.73 Cr to cyber frauds in 2024 alone.

Apple’s Antitrust Showdown

Apple’s Antitrust Showdown

- The Delhi HC has directed the corporate affairs ministry and the CCI to respond to Apple’s plea within a week, questioning why turnover from unrelated products should be included in penalties for alleged abuse of dominance.

- This comes as the big tech giant has challenged the Competition Act amendment, which allows the CCI to impose fines up to 10% of a company’s average global turnover. Apple argues that it could expose the company to penalties of around $38 Bn.

- The watchdog is defending the rule, saying it is necessary to ensure foreign companies with little or no India revenue can still be penalised for anti-competitive conduct. CCI even claimed that the plea aims to delay proceedings in its ongoing App Store probe.

Inc42 Markets

Inc42 Startup Spotlight

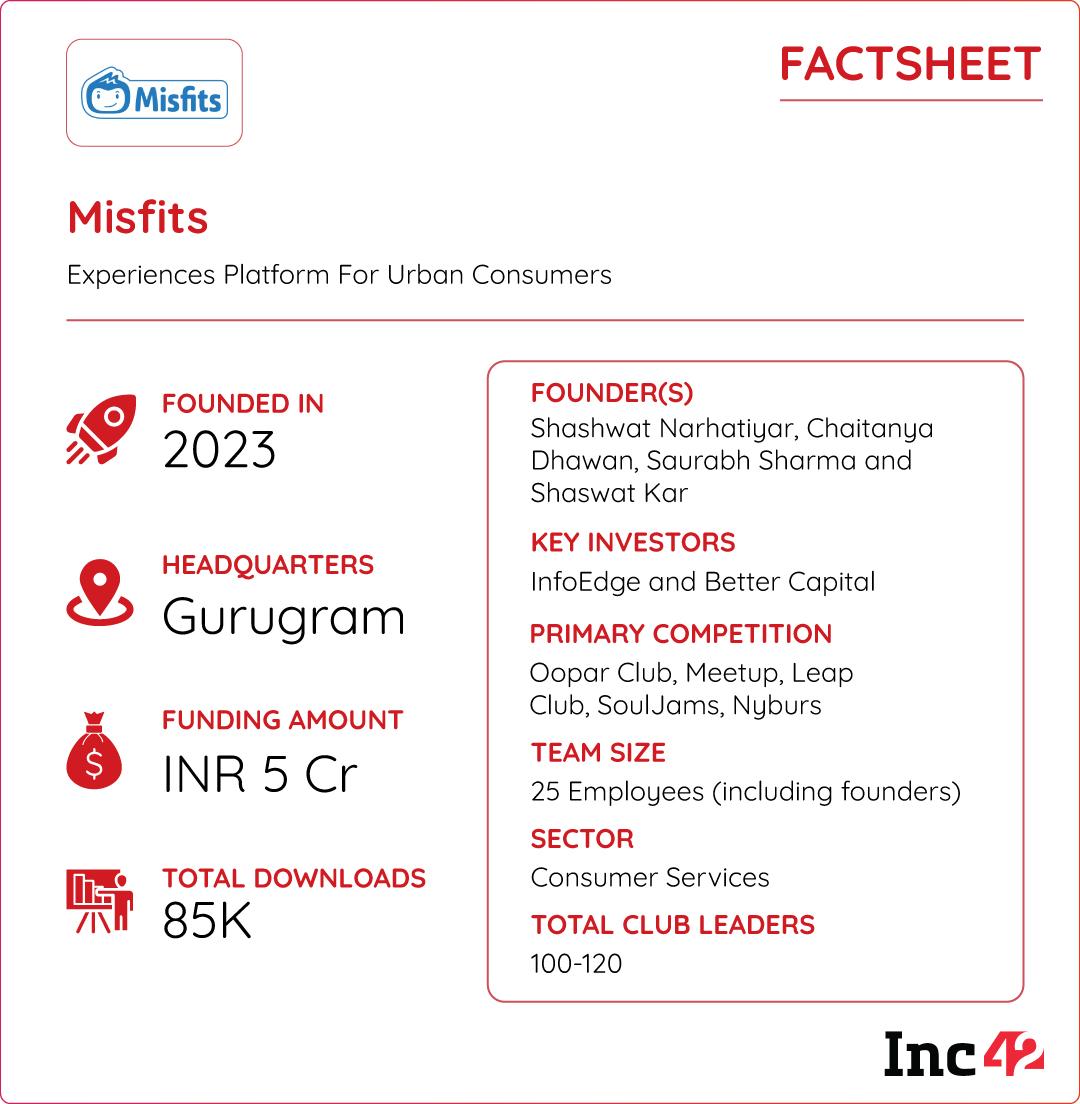

How Misfits Is Solving India’s Boredom Problem

In an era of fleeting attention spans, many people struggle with boredom and lack meaningful ways to spend their free time. Gurugram-based Misfits was born out of the founders’ own search for ways to connect with others.

The Misfits Solution: Founded in 2024, the startup took shape after founders started hosting house parties and game nights, which quickly evolved into a platform for community-driven activities. Misfits now enables users to join clubs and organise meetups for hobbies ranging from cricket and hiking to board gaming, music, dance, and more.

Community And Growth: The platform has grown to boast 85,000 downloads and a vibrant network of 150-200 club leaders, who earn income through ticket sales. Misfits targets millennials and Gen Z, aiming to expand beyond Gurugram to other Indian cities. The company is on track to hit INR 2.5 Cr in annual recurring revenue in FY26, with plans to scale monthly revenue to INR 60 Lakh by March 2026.

India’s live entertainment and ticketing market is set to surge, giving the startup a prime opportunity to meet the growing appetite for personalised, high-energy experiences. But the big test is still ahead. Can Misfits’ community-powered model really cure India’s boredom blues?

Infographic Of The Day

In November, PhonePe continued to lead the UPI charts with a commanding 46% market share, followed by Google Pay at 35% and Paytm at 7%. Here’s how the major fintech giants stacked up in the UPI race.

The post VinFast’s India Play, 2025’s Startup ESOP Boom & More appeared first on Inc42 Media.

https://ift.tt/Fs4fYuI

0 Comments