How Meesho Rewrote the Ecommerce Playbook

From a quick delivery platform called Fashnear to a social commerce network, and finally a full-stack marketplace, Meesho’s history is defined by aggressive experimentation. Now, the SoftBank-backed giant is taking its boldest step yet: entering the public markets as India’s first horizontal ecommerce company to list.

With the IPO set to open on December 3 at a price band of INR 105–111, aiming to raise over INR 5,400 Cr, all eyes are on Meesho and its CEO Vidit Aatrey. But how does a company survive—and thrive—in the shadow of Amazon and Flipkart?

The “Uber” of Logistics: In an exclusive interview with Inc42, Aatrey reveals the engine behind Meesho’s narrowing losses, which dropped by 72% YoY in H1 FY26. The secret is Valmo, their in-house logistics platform.

In an interview with Inc42, Aatrey draws a sharp parallel to Uber: just as the ride-hailing giant owns no cars, Meesho owns no trucks or warehouses. Instead, it utilizes a workforce that is 57% tech-focused to optimize existing logistics networks. This asset-light model has been the game-changer for their unit economics.

Ignoring the Hype: While the rest of the ecosystem burns cash chasing the “quick commerce” trend, Aatrey is resolute about sitting it out. He argues that for India’s mass market, price trumps speed every time. Consequently, Meesho is doubling down on affordability and maintaining its zero-commission model for sellers—a feature Aatrey claims is non-negotiable for democratizing commerce.

Profits Over Pivots: For investors, the most critical takeaway is Meesho’s financial maturity. Aatrey emphasizes that innovation no longer comes at the cost of the balance sheet. With two years of positive free cash flow and a simplified, AI-driven ad revenue model, the company is pitching itself not as a cash-burning startup, but as a disciplined tech enabler.

As the company prepares to ring the bell, the question remains: can this asset-light model sustain growth in the fierce public market? Read the full interview to understand how Aatrey & Co plan to leverage the IPO to take Meesho to the next level…

From The Editor’s Desk

Lenskart’s Q2 Win

- The omnichannel eyewear giant posted a 19.8% YoY jump in net profit to INR 103.4 Cr in Q2 FY26, on the back of top line rising 20.8% YoY to INR 2,096.1 Cr, improved margins and rapid network expansion.

- In its first financial disclosures post listing, the company also said that it will launch its AI-powered smart glasses by Q4 FY26, which will combine prescription lenses with features like UPI payments and health tracking.

- The results follow Lenskart’s muted IPO. The company’s INR 7,000 Cr public issue was primarily criticised for its sky-high valuation, OFS-heavy IPO and concerns over profitability.

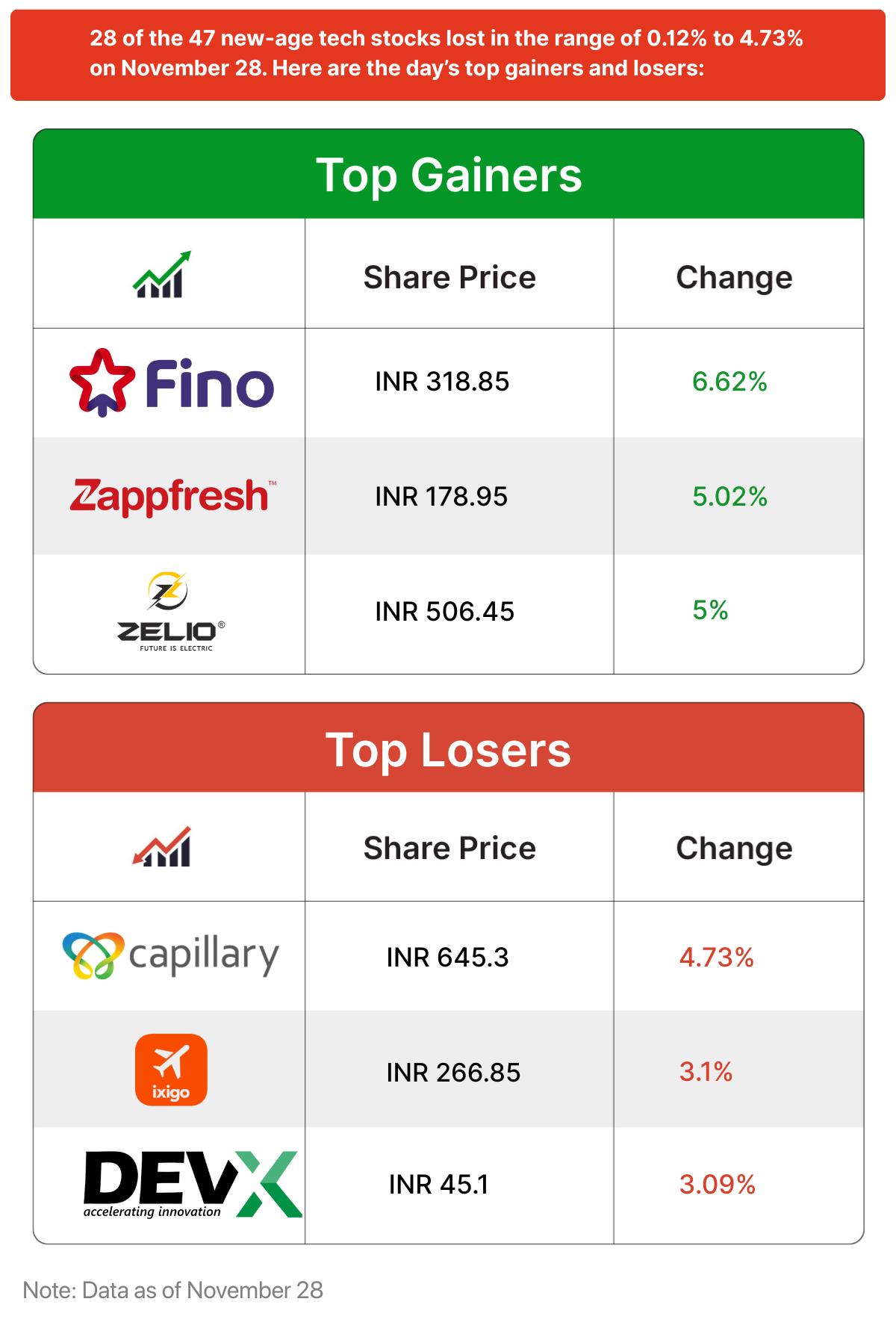

Mixed Week For Startup Stocks

- Of the 47 new-age tech stocks under Inc42’s coverage, 29 ended last week in the red, while the remaining 17 posted gains. While Zelio E-Mobility and Fino Payments Bank emerged as the biggest gainers, Smartworks, and PW were the biggest losers.

- Largely to blame for this performance were depreciating rupee and persistent FII outflows. Counterbalancing these adverse factors were strong domestic institutional inflows, softer US bond yields and benign crude oil prices.

- The combined market cap of these 47 new-age tech companies stood at $131.27 Bn at the end of last week, slightly lower than the preceding week’s $131.52 Bn, indicating consolidation after recent IPO-driven rallies.

Jar Reins In FY25 Losses

- The wealth tech platform halved its net losses YoY to INR 50.5 Cr in FY25 on the back of its foray into ecommerce jewellery segment and growing operating revenues, which shot up 50X YoY to INR 2,447.8 Cr due to certain accounting changes.

- Going forward, the wealthtech startup plans to further monetise its existing user base by cross-selling various financial products like lending and insurance offerings.

- Founded in 2021, Jar operates a digital gold-focussed investment platform that allows users to invest as little as INR 10 in digital gold. It claims to serve more than 35 Mn users, and has raised more than $111 Mn to date.

Weekly Funding Surge Continues

- Indian startups cumulatively raised $195.2 Mn across 24 deals last week, up 14% from $171 Mn raised in the previous week. Ripplr and Square Yards took home the biggest cheques at $45 Mn and $35 Mn, respectively.

- Fintech dominated investor interest by raising $48 Mn, while cleantech also clinched four deals totalling $20.5 Mn last week.

- Startup IPO activity continued to intensify as Meesho and Aequs finalised their price bands and dates for their IPOs, while Zetwerk shortlisted six bankers to helm its $750 Mn issue.

How Indian Startups Fared In FY25?

- The 110 new-age tech startups under Inc42’s coverage reported a cumulative top line of INR 2.83 Lakh Cr in FY25, up 20.3% from INR 2.35 Lakh Cr in FY24. Most of these startups remain profitable.

- Of these, 50 reported a cumulative net loss of INR 24,541.8 Cr, while the remaining 60 generated a cumulative net profit of INR 13,487.2 Cr.

- The Indian startup ecosystem has undergone a seismic shift post-2022, with new-age tech companies rapidly pivoting toward profitability, slashing promotional spends, curbing pay hikes, and focusing on unit economics.

Inc42 Markets

Inc42 Startup Spotlight

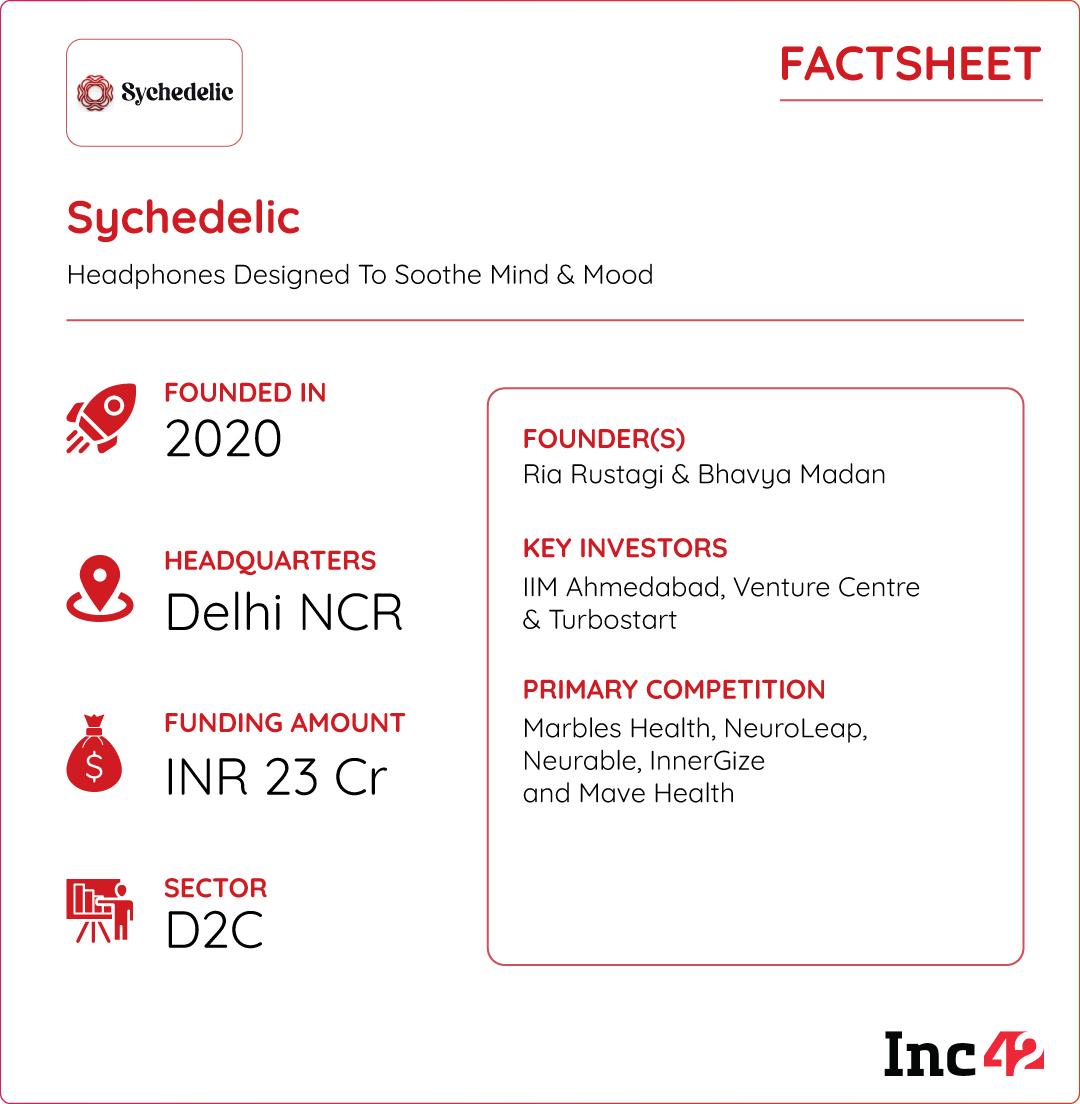

How Sychedelic Is Reimagining Mental Wellbeing

The global wearable market is booming, yet there are very few solutions catering to India’s mental health crisis. With stress, anxiety and sleep issues affecting millions of people in the country, Sychedelic is stepping in to bridge the gap between technology and mental wellness.

From Headbands to Headphones: Founded in 2020, Sychedelic was initially known as Neuphony, which offered a smart headband for tracking brain health. After struggling to scale, the founders pivoted to smart headphones equipped with PPG sensors for heart rate monitoring and TDCS (transcranial direct current stimulation) to target stress, anxiety, and sleep issues. Their vision is to make mental health support accessible through everyday devices.

Tech & Ambition: Sychedelic claims that its headphones have an efficacy of 92% and are priced at INR 25,000, targeting both Indian and US markets, with plans to lower costs as production scales. The founders have raised INR 10 Cr and generated INR 70 Lakh in revenue since launch.

Challenges Remain: While early studies suggest TDCS can improve symptoms of anxiety and OCD, long-term efficacy and safety remain unclear. With a high price point and limited clinical validation, can Sychedelic overcome scepticism and scale in India’s price-sensitive market?

Infographic Of The Day

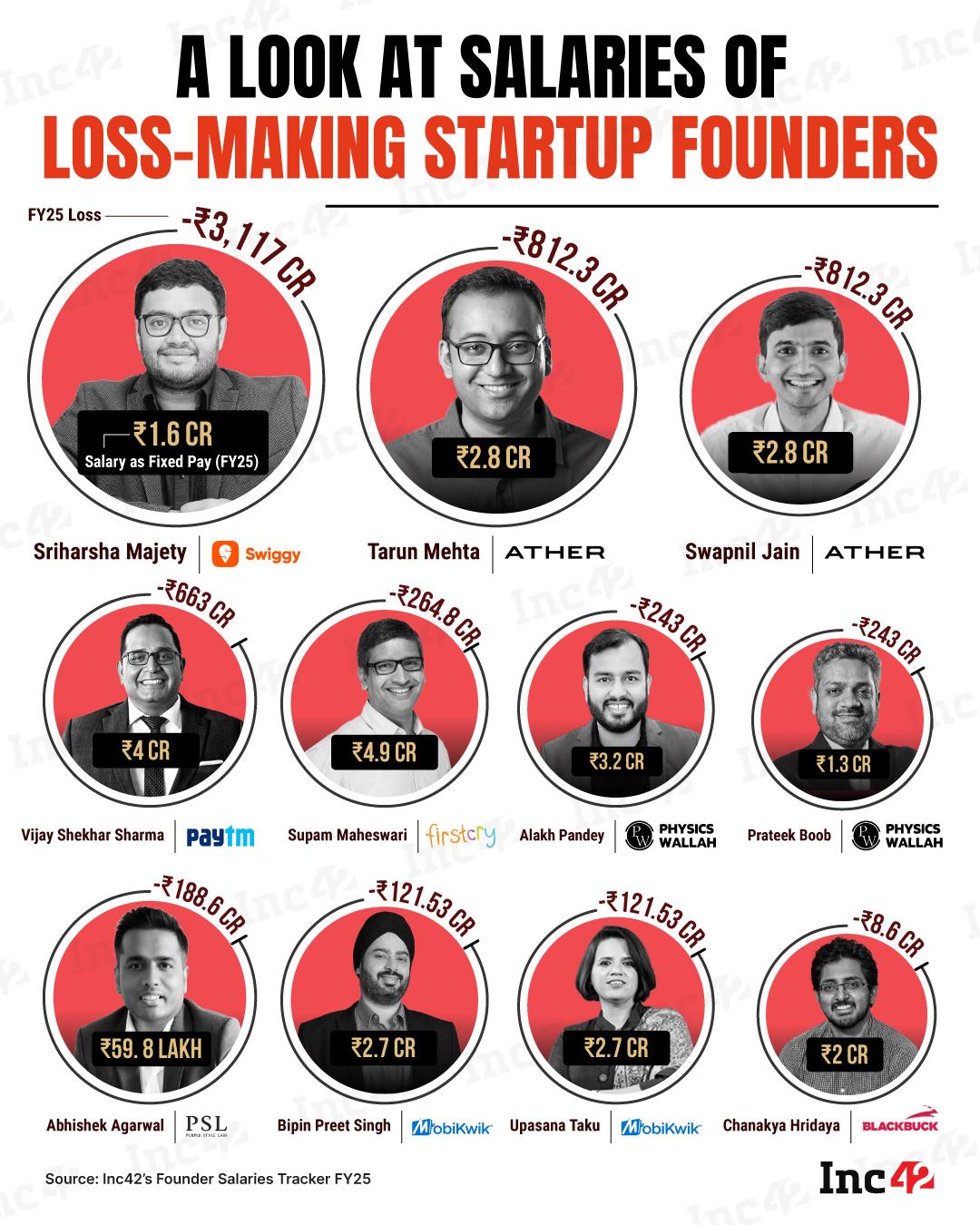

Despite posting sizable losses in FY25, many of India’s top startup founders continued to draw significant salaries. Inc42’s Founder Salaries Tracker reveals just how much...

The post Meesho’s Edge, Lenskart’s Q2 Snapshot & More appeared first on Inc42 Media.

https://ift.tt/ZkThyYf

0 Comments