Zetwerk Revives IPO Plans

Zetwerk is back on the IPO bandwagon. Barely eight months after delaying its listing plans amid market uncertainties, the B2B manufacturing giant has now taken a U-Turn and roped in six bankers to helm its public issue. So, how do Zetwerk’s IPO plans stack up?

Zetwerk’s IPO Gameplan: The contract manufacturing startup is looking to raise up to $750 Mn (INR 6,600 Cr) via its IPO, which will be dominated by a fresh issue. With plans to submit its DRHP confidentially early next year, it has assembled a syndicate of investment bankers, including Kotak Mahindra Capital, JM Financial, HSBC, and others, to lead the issue.

A Full-Stack Juggernaut: Founded initially as a SaaS company that helped manufacturing companies organise their supplier databases, Zetwerk has morphed into a full-stack supply chain partner for enterprises across the globe. It operates a network of 100+ units that build everything from industrial components and electronics to EV parts and hardware, while also managing procurement logistics and delivery.

Zetwerk’s Edge: What could work for the company’s potential IPO is its deep factory networks, in-house engineering expertise, an asset-light business model and expansion into high-growth sectors like electronics and renewables. With a $3.1 Bn private valuation, the company is positioning itself as a key beneficiary of the “China+1” diversification wave and production-linked-incentives (PLIs) in manufacturing.

Legal Clouds On The Horizon: Among the risks, the company is locked in a legal battle in the US with Ayr Energy, founded by an ex-executive, over alleged misuse of trade secrets and poaching of key employees. Additionally, the capital-intensive nature of its B2B manufacturing model may raise concerns about margin pressures and profitability timelines.

With deep-pocketed rivals like Infra.Market and OfBusiness on its tail, can Zetwerk contain the narrative before roadshows begin? Let’s find out…

From The Editor’s Desk

Neo Group Nets $25 Mn

- The asset management company has raised INR 222 Cr in a follow-on round led by Atha Group and Morde Foods. This is Neo’s third fundraise this year, signaling strong investor confidence and accelerated growth momentum.

- Founded in 2021, Neo Group delivers advisory and yield-based investment products to HNIs, UHNIs and family offices. The company reportedly has more than INR 40,000 Cr in assets under management.

- With this, Neo joins a growing cohort of wealth tech startups attracting capital recently, such as Wealthy’s INR 130 Cr round, Dezerv’s INR 350 Cr fundraise and Groww’s acquisition of Fisdom.

Yatra Reshuffles Top Brass

- The listed travel tech OTA has roped in ex-Mercer India president Siddhartha Gupta as its new CEO. Outgoing chief executive and cofounder Dhruv Shringi has been appointed as the new executive chairman.

- The leadership shift is expected to support Yatra’s B2B-focused strategy and strengthen its positioning in the rising corporate and consumer travel segments.

- Founded in 2006, Yatra claims to cater to over 1,300 large enterprises and 59,000 SMEs, with services spanning ticketing, hotels, and exhibitions. The OTA saw its profits soar 101% YoY to INR 14.3 Cr in Q2 FY26 against a top line of INR 351 Cr, up 48% YoY.

Google, Accel Unite To Fuel AI Boom

- The big tech giant’s AI Future Fund has banded together with the VC major’s incubation platform, Atoms, to launch a new India cohort. Under this, the duo will co-invest in pre-seed AI startups, offering up to $2 Mn in funding.

- The collaboration will offer not only capital, but support such as mentorship, product development aid, global networking and early access to DeepMind models.

- Overall, the homegrown GenAI market is projected to become a $17 Bn opportunity by 2030, driven by expanding data centre infrastructure investments, a growing talent pool, a myriad of use cases, and the push for sovereign AI ambitions.

Salesforce India Rolls In Profits In FY25

- The SaaS giant’s India operating revenue crossed the INR 13,000 Cr mark in FY25, up 46% YoY. Meanwhile, profits also soared 45% YoY to INR 1,292.3 Cr during the fiscal.

- Going forward, Salesforce plans to ramp up its digital and AI skilling initiatives, with an eye on training 1 Lakh learners in the new technology by mid-2026. It is also deepening its AI-led capabilities, especially in customer service.

- Salesforce’s plans align with growing AI adoption in critical enterprise functions such as customer service, sales and CRM. While challenges like data governance persist, businesses continue to leverage the tech to optimise costs and improve workflows

Mobavenue Eyes INR 100 Cr

- The martech startup’s board has approved a proposal to issue 9.19 Lakh shares at INR 1,088 apiece to raise the capital, mainly from non-promoter investors to fund acquisitions and bolster its AI stack

- Founded in 2017, Mobavenue helps digital-first brands advertise beyond the walled gardens of big tech giants. It claims that its stack delivers measurable advertising outcomes through its proprietary technology stack

- Going forward, the company plans to undertake aggressive global expansion across key markets like North and South America, the UK, the EU, and East Asia with local hiring. Even on the financial front, its profits surged 21.7% QoQ to INR 7.3 Cr in Q2 FY26

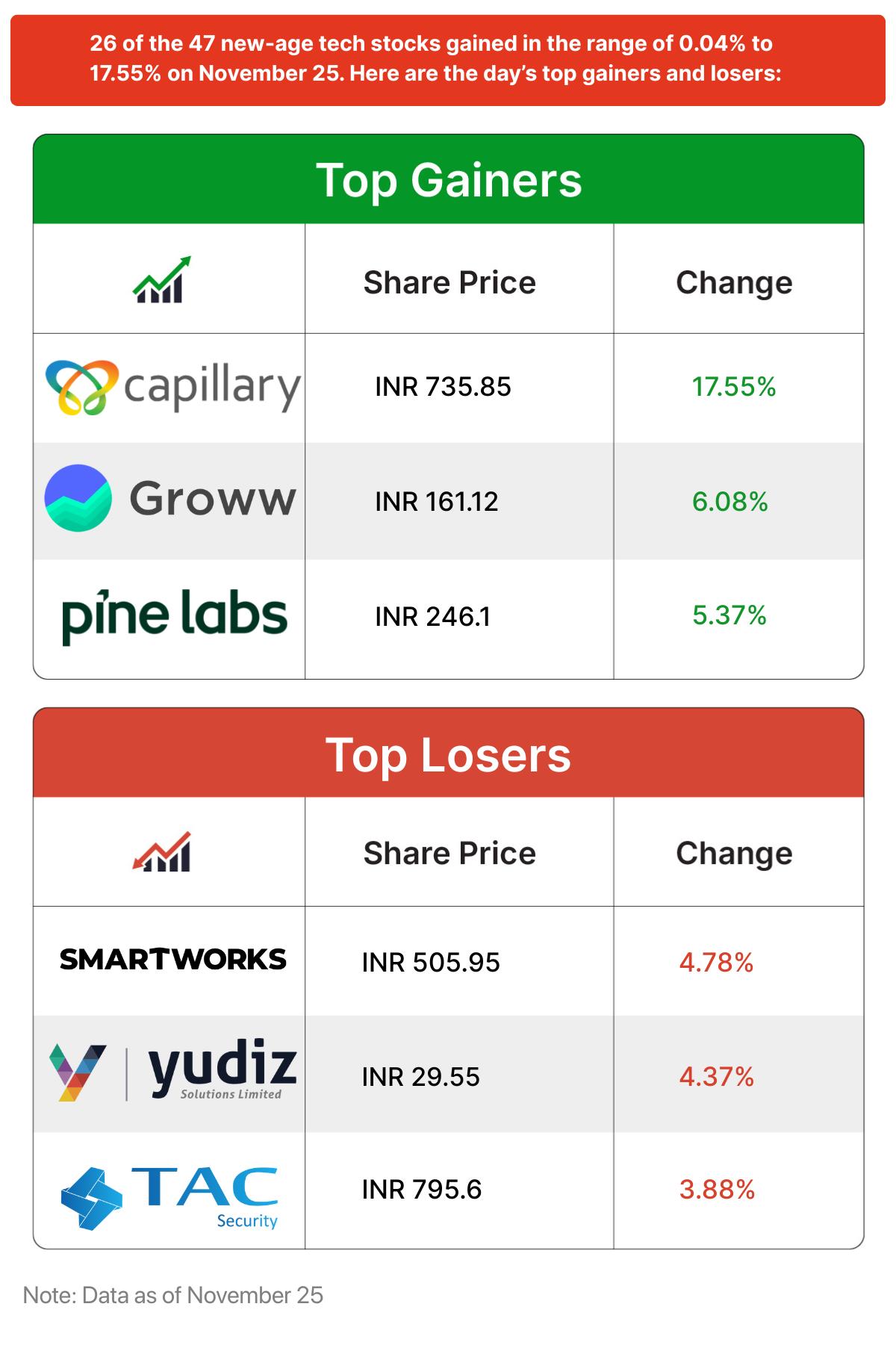

Inc42 Markets

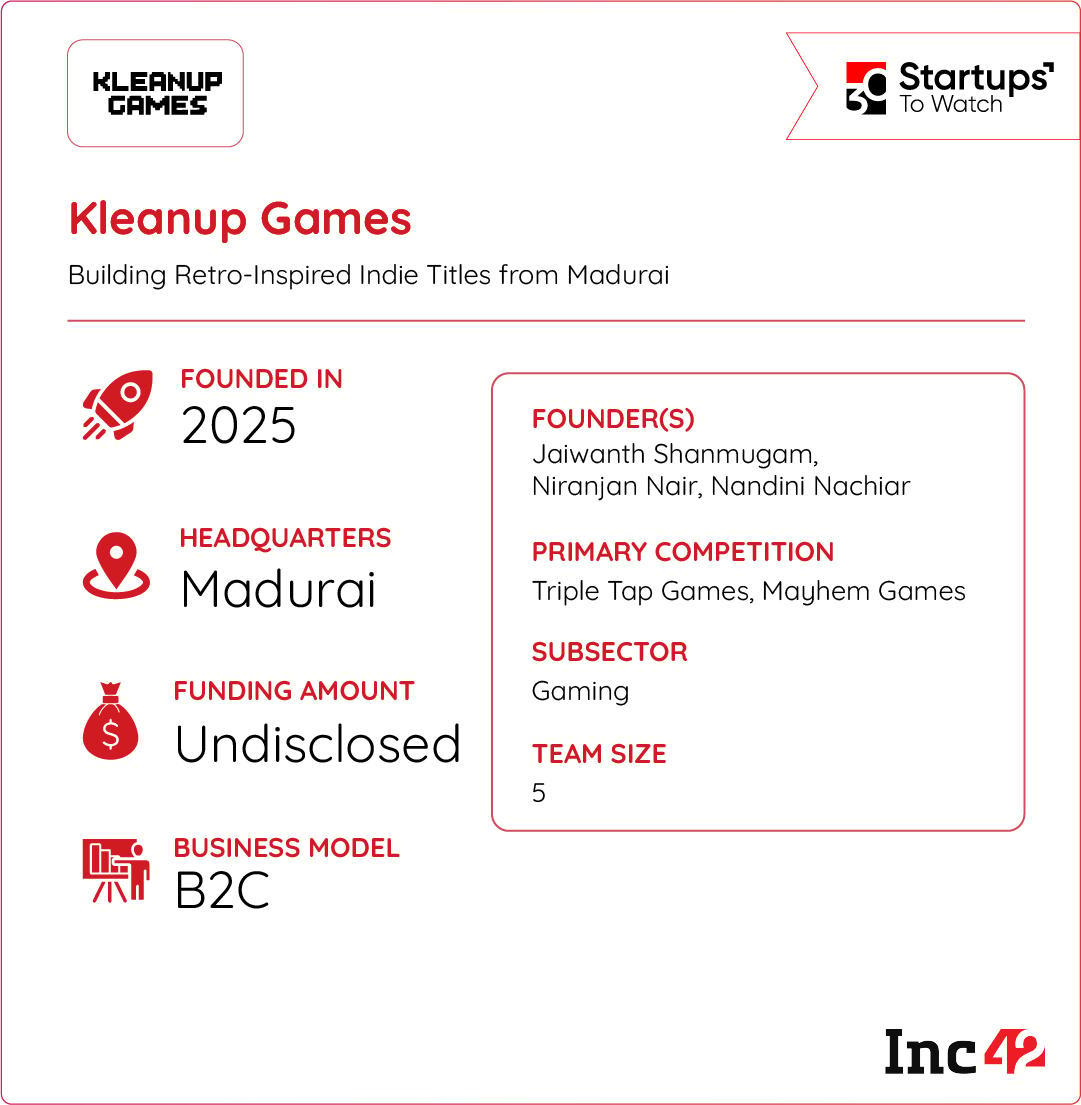

Inc42 Startup Spotlight

Can Kleanup Put India On The Global Gaming Map?

India’s gaming market is vast, yet global studios dominate development and publishing. Despite a huge player base of over 450 Mn, only a few homegrown developers are creating original titles rooted in local culture. One of them is Kleanup Games.

Design-Led & India-Bred: Founded earlier this year, Kleanup is creating original indie games deeply ingrained in local creativity, while appealing to global audiences. Their debut title, CHROMADI, is a retro-style arcade shooter inspired by classic gameplay fused with unique color-mixing mechanics and vibrant storytelling.

Fostering Indie Game Revolution: Buoyed by crucial funding support and mentorship from KRAFTON India Gaming Incubator, the studio continues to build its philosophy around design-led, culturally resonant games that stand out in a crowded market. With a core team from Madurai, Kleanup sits between cultural expression and international indie demand.

A Growing Market: India’s gaming audience is one of the world’s largest and fastest-growing, making it a fertile ground for Kleanup. As indie games gain traction in global markets, Kleanup’s blend of Indian cultural elements and classic game mechanics positions it to ride the wave of increasing demand for authentic, unique gaming experiences.

But, can Kleanup Games emerge as a trailblazer in the global gaming space?

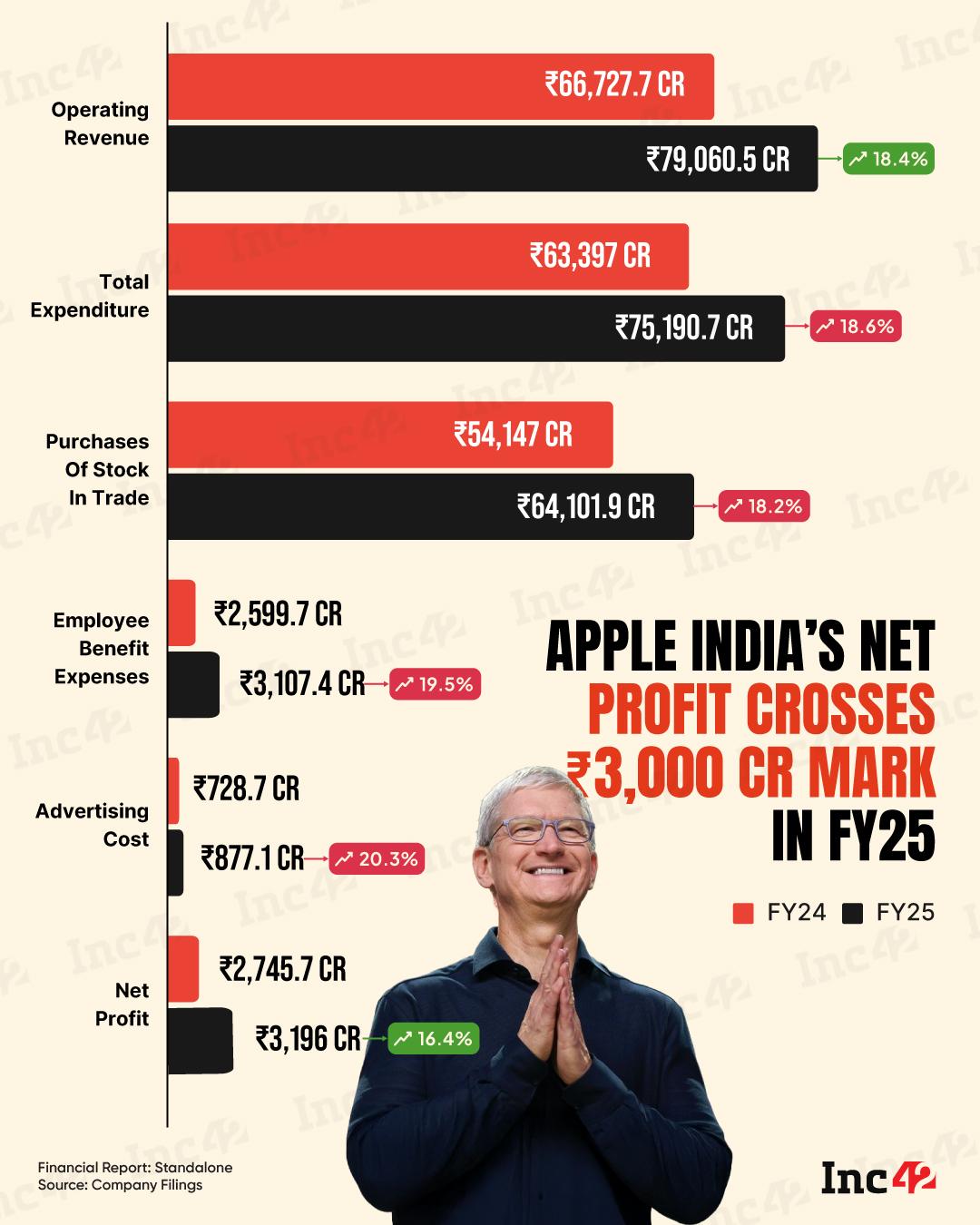

Infographic Of The Day

Apple India hit a major milestone in FY25 – net profit surged to INR 3,196 Cr while revenue stood equally strong at INR 79.060 Cr. Here is how the iPhone maker is scaling at a record speed in the country…

The post Zetwerk’s IPO Redux, Neo Bags $25 Mn & More appeared first on Inc42 Media.

https://ift.tt/a0TNVjA

0 Comments