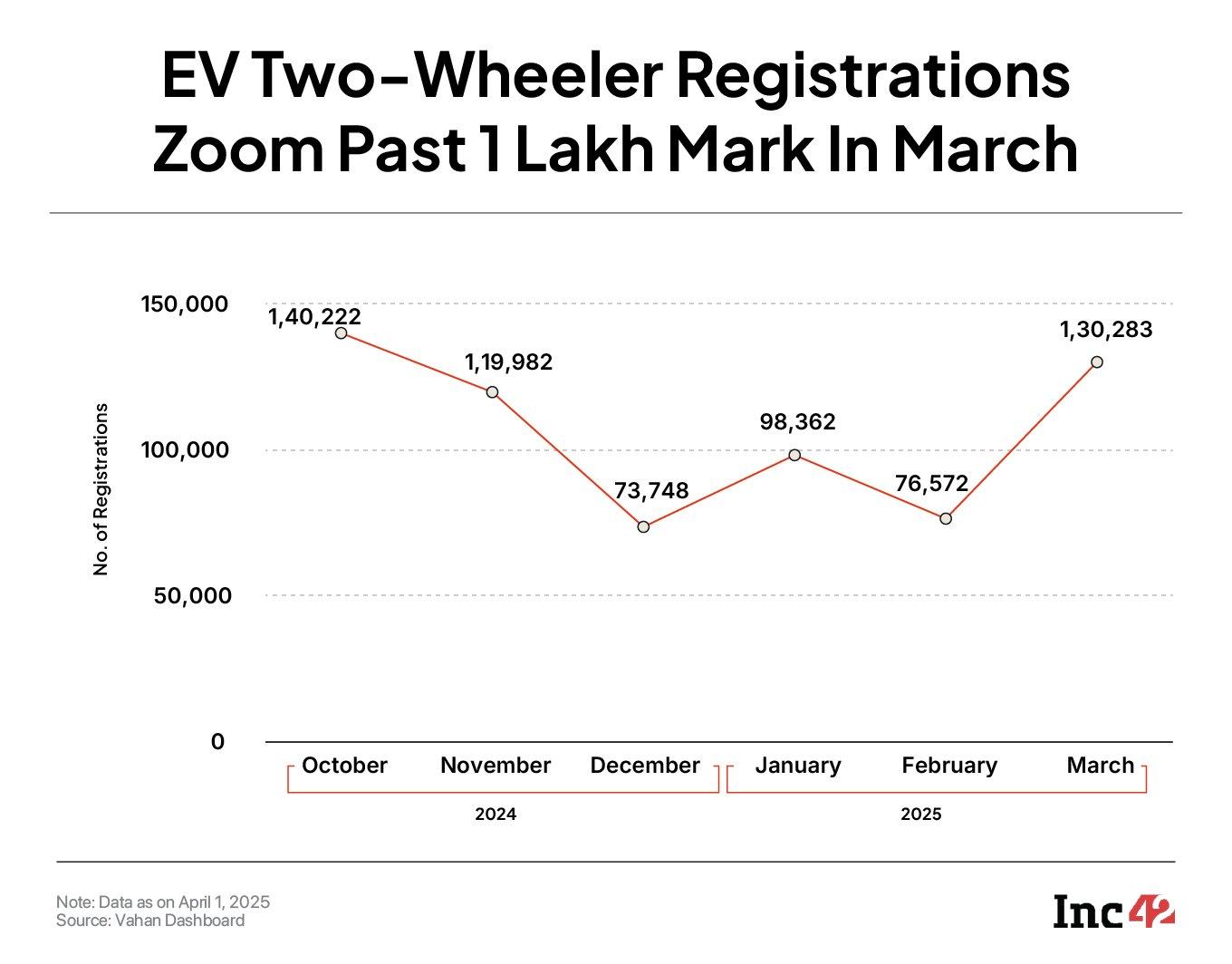

Electric two-wheeler registrations spiked above the 1 Lakh mark in March for the first time in four months, fuelled by aggressive growth of key players like Bajaj Auto, TVS Motor and Ola Electric.

As per Vahan data as on April 1, 2025, registrations of electric two-wheelers in the country zoomed over 70% to 1.30 Lakh units last month from 76,572 units in February.

Bajaj Auto and TVS Motor surpassed Bhavish Aggarwal-led Ola Electric yet again in terms of escooter sales in March, continuing their dominance in the segment.

Bajaj Auto topped the charts, with registrations of its Chetak escooters surging nearly 62% to 34,863 units last month from 21,537 units sold in February. However, its market share shrank to under 27% in March from 28% in February.

With a market share of a little over 23%, TVS Motor retained its second spot in the electric two-wheeler segment. Its escooter registrations stood at 30,454 units in March, up 61% from 18,911 units in the previous month.

Ola Electric saw registrations of its EV two-wheelers skyrocket 171% to 23,430 units last month from 8,653 units in February. As a result, its market share improved to 18% in March from 11% held in the previous month.

It must be noted that Ola Electric’s EV sales took a beating in the latter half of the fiscal year ended March 2025 (FY25) amid heightened competition from Bajaj and TVS.

However, in an investor presentation released yesterday, Ola Electric said it maintained its leadership position in the electric two-wheeler segment in FY25 with a 30% market share and registration of 3.44 Lakh units.

Overall, electric two-wheeler registrations in the country climbed more than 21% to 11.49 Lakh units in FY25 from 9.48 Lakh units in the previous fiscal year, as per Vahan data.

It is pertinent to mention that Ola Electric claimed in February that it sold over 25,000 units and the registration of its vehicles on the Vahan portal was temporarily disrupted due to its negotiations with its registration vendor.

In a statement yesterday, the company said that its daily registration volumes and backlog clearance are steadily improving. “We have nearly cleared the February backlog and expect to complete the remaining February–March registrations in April 2025,” it added.

Top OEMs See Rise In EV Registrations

Besides the top three players, others like Ather Energy, Greaves and Pure EV also saw a rise in their two-wheeler registrations last month.

IPO-bound Ather’s escooter registrations stood at 15,446 last month, up 29% from 11,944 EVs registered in February. However, its market share declined to under 12% in March from 15.6% in the previous month despite the uptick in registrations.

It is pertinent to mention that market regulator SEBI greenlit Ather Energy’s draft red herring prospectus (DRHP) for INR 3,100 Cr+ IPO in January. As per reports, the EV manufacturer is eyeing a valuation of $1.2 Bn for its IPO, which is expected to be launched in April.

Hero MotoCorp, an emerging player in the space, saw its market share climb to a little over 6% in March with 7,977 EV units registered during the month. Meanwhile, Greaves, under its flagship brand Ampere, saw registrations zoom 51% to 5,663 EV units in March from 3,729 units registered in February.

Similarly, the likes of IPO-bound Pur Energy (Pure EV), Lectrix, Kinetic Green Energy, Revolt and Oben Electric also saw registrations of their two-wheeler EVs rise last month, albeit on a much smaller scale.

Two-Wheelers Driving EV Adoption In India

This comes at a time when the competition in the two-wheeler EV market is intensifying and the likes of Bajaj, TVS and Ola Electric are making all efforts to gain, or at least, retain their market share.

These players have launched a number of new models in recent months at competitive price points. For instance, Ola Electric forayed into the electric motorcycle market with the launch of Roadster X series, which comes at an introductory price of INR 84,999. Last month, the EV manufacturer also kicked off deliveries of its Gen 3 portfolio of Ola S1 escooters. On the other hand, Bajaj Auto rolled out new EV models of its iconic Chetak scooter.

Besides, smaller players are also entering new segments. For instance, high-end ebike maker Ultraviolette forayed into the escooter market with the launch of ‘Tesseract’ last month.

Amid all these, the total EV registrations in the country, across categories, shot up nearly 44% to 2.11 Lakh units in March from 1.47 Lakh units in the month prior.

For the entire fiscal year 2024-25, total EV registrations rose 22% to 20.46 Lakh units from 16.83 Lakh units in FY24. This implies that electric two-wheelers accounted for 56% of all EV registrations in FY25.

The post EV 2-Wheeler Registrations Cross 1 Lakh Mark In March, Bajaj & TVS Motor Continue Dominance appeared first on Inc42 Media.

https://ift.tt/SrBdCHv

0 Comments