Ola Electric Activates Hyper Delivery Mode

Ola Electric is piloting Hyper Delivery, a same-day registration and delivery service. Starting with Bengaluru, it plans a pan-India rollout in a phased manner this quarter.

What’s The Strategy? The EV maker aims to achieve this by automating a majority of the registration process, which will help it remove middlemen and strengthen margins. Meanwhile, the company is also working on trimming its delivery times to 3-4 days in Q1 FY26 from 12 days in Q4 FY25.

Over the past few months, the company has scaled up to 4,436 sales outlets. It is this network Aggarwal seems to be banking on for his Hyper Delivery ambition.

Market Leader Despite Hiccups: Ola Electric’s FY25 registrations stood at 3.44 Lakh units, which helped it capture a 30% market share. However, in March, the EV maker trailed behind legacy players like Bajaj Auto and TVS Motor and could only register 23,430 units with an 18% market share.

The dip was not unexpected as it was in the process of renegotiating contracts with registration agencies. While this led to a delay in its EV registrations for February and March, the company expects to clear the backlog in April.

Many Crises At The EV Maker: The EV maker is also under the scanner of regulators for setting up showrooms and service centres without necessary trade certificates. Then, its mounting losses (INR 564 Cr in Q3 FY25), and dwindling stock prices (down almost 37% YTD) are only dragging it down.

Nevertheless, it is a step in the right direction, but the real test lies in whether Ola Electric can crack the model without burning more capital. As the company shifts gears, let’s take a look at what Ola Electric’s Hyper Delivery mode has on offer.

From The Editor’s Desk

Scapia Bags $40 Mn: The travel-focussed fintech startup has raised the capital as part of its Series B round led by Peak XV Partners. The startup offers co-branded credit cards with zero-forex markup and domestic lounge access to travellers.

Samara’s $2 Bn Investment Thesis: With a sharp focus on high-growth sectors, Samara Capital acquires controlling stakes and works closely with management teams to accelerate growth and value creation. So, how exactly is this founder-friendly playbook working for Samara?

Kissht Eyes $225 Mn IPO: The digital lending startup has shortlisted ICICI Securities, UBS Securities, and Motilal Oswal as bankers for its $225 Mn IPO at a valuation of up to $1.1 Bn. The company is looking to file its draft IPO papers by June.

ZeCa Capital’s INR 150 Cr Fund: The VC firm has received SEBI’s nod to float the fund, which will invest in cleantech startups. It has already received commitments from a few CXOs and expects to mark the first close of the fund at INR 40 Cr by April-end.

DevX Refiles DRHP: As per its updated DRHP, the coworking major has increased the size of its fresh issue to 2.75 Cr equity shares from 2.47 Cr shares earlier. The startup clocked a net profit of INR 38.4 Lakh in H1 FY25 against an operating revenue of INR 59.4 Cr.

Flipkart’s Marketplace Biz Nets $379 Mn: The ecommerce giant’s Singapore-based holding company has infused the funds in its India marketplace arm. As part of this, the company’s board approved a proposal to issue 4.7 Lakh shares at INR 69,014.17 each.

Tonbo Imaging Nets INR 175 Cr: The defence tech startup has raised the capital as part of its Series D pre-IPO round from Florintee Advisors and EXIM Bank at a valuation of INR 1,500 Cr. Tonbo Imaging builds AI-based seekers and coastal surveillance systems.

Respite For Zomato: The NCLT has dismissed an insolvency petition filed by Nona Lifestyle against the foodtech giant for non-payment of dues worth INR 1.64 Cr. The tribunal dismissed the case after the petitioner failed to serve a proper notice under section 8 of the IBC.

Inc42 Startup Spotlight

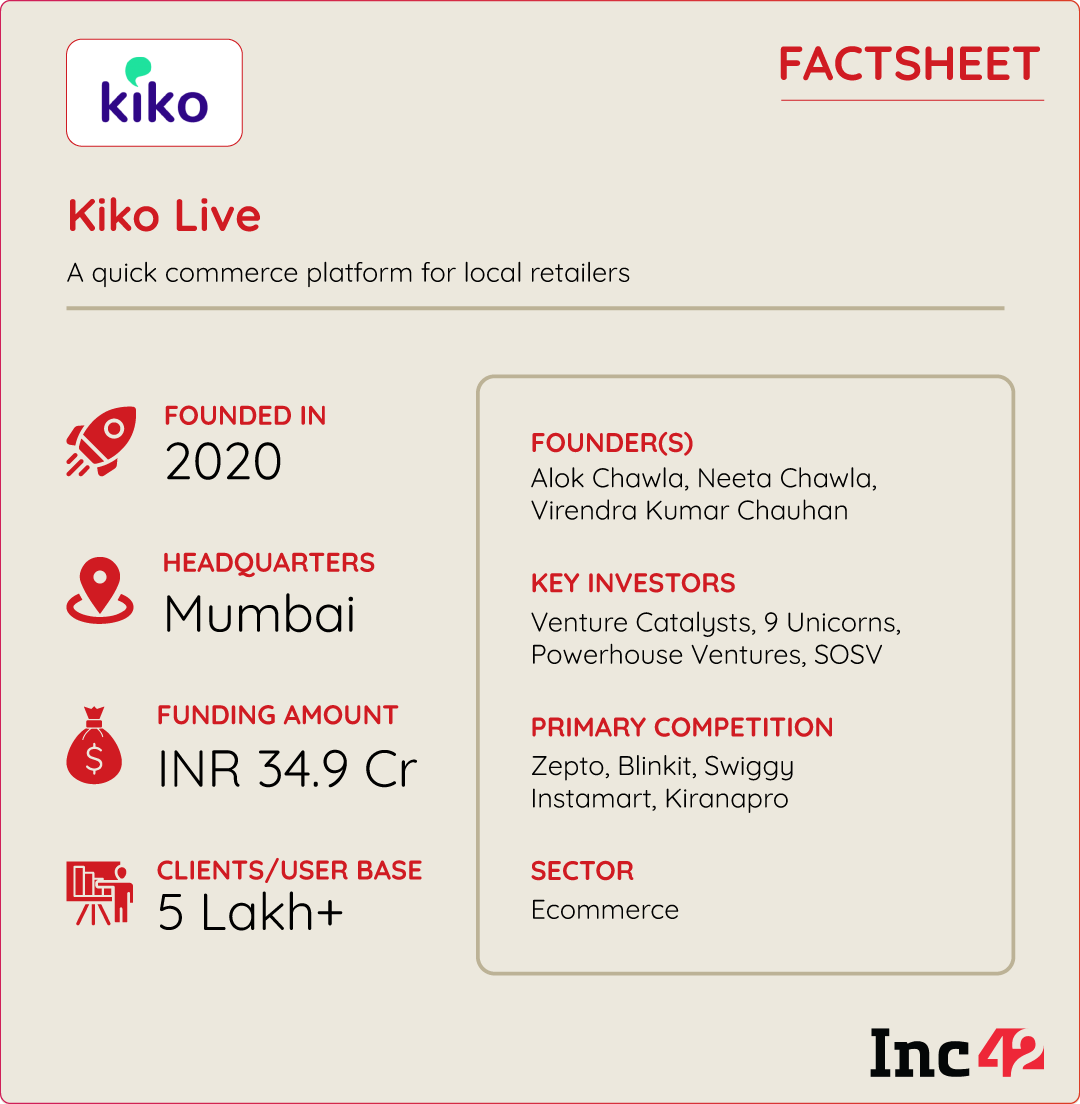

Can Kiko Live Give Kiranas The Edge Over Quick Commerce Giants?

As India’s quick commerce giants sprint from fast to ultra-fast deliveries, cracks in the business model have begun showing up. As per Zomato CEO Deepinder Goyal, the quick delivery ecosystem is burning close to INR 5,000 Cr every quarter.

At the centre of this pressure is the dark store model, which promised efficiency but is now weighed down by costs, operational complexity, and diminishing returns. To address this dark store fatigue, Alok Chawla, Neeta Chawla, and Virendra Kumar Chauhan founded Kiko Live in 2020.

The Genesis & The ONDC Boost: The trio spotted an opportunity — not in rivalling q-commerce giants, but in digitising local retailers via ONDC, WhatsApp ordering, and B2B/D2C fulfilment tools. On the back of ONDC, Kiko Live today handles 3,000 orders every day. Today, it’s processing a monthly GMV of INR 1.5 Cr.

Kiko’s Shot At The Q-Commerce Pie: The company has bigger plans on the anvil. It plans to cross the 10,000+ order milestone in the next two to three months and reach the INR 5 Cr GMV mark in the next six months.

As quick commerce giants face downgrades, has the 10-minute race stretched the dark store model too thin and can Kiko help kiranas reclaim the edge?

The post Ola Electric In Hyper Delivery Mode, Scapia Bags $40 Mn & More appeared first on Inc42 Media.

https://ift.tt/3b5jkAr

0 Comments