OYO Eyes INR 1,100 Cr In FY26 PAT

OYO is on a dream run. After reporting INR 229 Cr in profits in FY24, the hospitality juggernaut claims to be well-positioned to clock a massive profit of INR 1,100 Cr in FY26.

So, what’s powering this optimism? Well, according to founder and CEO Ritesh Agarwal, OYO’s recent acquisition of US-based G6 Hospitality, the parent of Motel 6 and Studio 6, is expected to bring in healthy improvement in OYO’s top and bottom lines.

Not just this, G6 is also expected to contribute an EBITDA of INR 630 Cr in the upcoming fiscal, pushing OYO’s combined EBITDA to over INR 2,000 Cr in FY26.

This is in line with what sources within the company told Inc42 last year. At the time, OYO anticipated the G6 Hospitality acquisition to start giving quick returns.

While FY26 is still far, the hospitality giant continues to roll in profits. While the company projects profits worth INR 700 Cr in the ongoing fiscal, its net profit jumped nearly 6X to INR 166 Cr in Q3 FY25 and revenues rose 31% YoY to INR 1,695 Cr.

Notably, Agarwal’s optimism about OYO’s financial health comes at a time when the company’s lenders are breathing down its neck to fast track its IPO or clear looming debt repayments. Such has been the pressure that creditors have directed OYO to list by October this year or cough up $383 Mn it owes as part of a loan package.

Amid the mounting pressure to clear the investor dues, here’s a look at OYO’s FY26 PAT projections. Continue reading…

From The Editor’s Desk

Darwinbox Bags $140 Mn: The HR tech startup has raised the capital in a round co-led by Partners Group and KKR. The startup, which entered the unicorn club in 2022, offers comprehensive solutions for recruitment, onboarding, payroll, and people analytics.

NoPaperForms Lines Up Bankers For IPO: The Info Edge-backed enterprise tech startup has appointed IIFL Capital and SBI Capital as bankers for its public listing. It plans to file its DRHP in the next couple of quarters for an IPO at a valuation of INR 2,000 Cr.

Peak XV’s Shraeyansh Thakur Quits: The investor at the VC firm has announced his departure to embark on his entrepreneurial journey. This marks the fifth major exit at Peak XV Partners in the last 12 months.

Ola Electric Gets Sops: The EV major has become the first two-wheeler EV maker to receive incentives under the Centre’s scheme for automotive and auto components. The company has been granted subsidies worth INR 73.7 Cr based on its FY24 sales.

Zetwerk Nets $5 Mn: The IPO-bound manufacturing unicorn has raised the capital in a round led by Arc Investments and Oriental Biotech. The company’s board passed a special resolution in February to raise the sum via issuance of 9.93 Lakh CCPS at INR 432.718 apiece.

Tesla All Set For India Entry: The EV maker has signed a lease agreement to open its first showroom in the country in Mumbai’s Bandra Kurla Complex. The deal has set a new national benchmark, with Tesla set to pay INR 3.87 Cr for the first year for a 4,003 sq ft space.

Saina Nehwal Backs Naarica: The femtech brand has roped in the badminton star as an investor and brand ambassador. The startup sells reusable period underwear and claims to prevent urinary tract infections with its toxin-free and anti-microbial technology.

India Preps For Satcom Launch: India may launch satellite internet services by June as TRAI is in the final stages of finalising the pricing for spectrum allotment. With this, satcom operators will be able to provide high-speed internet in remote and maritime areas.

Inc42 Startup Spotlight

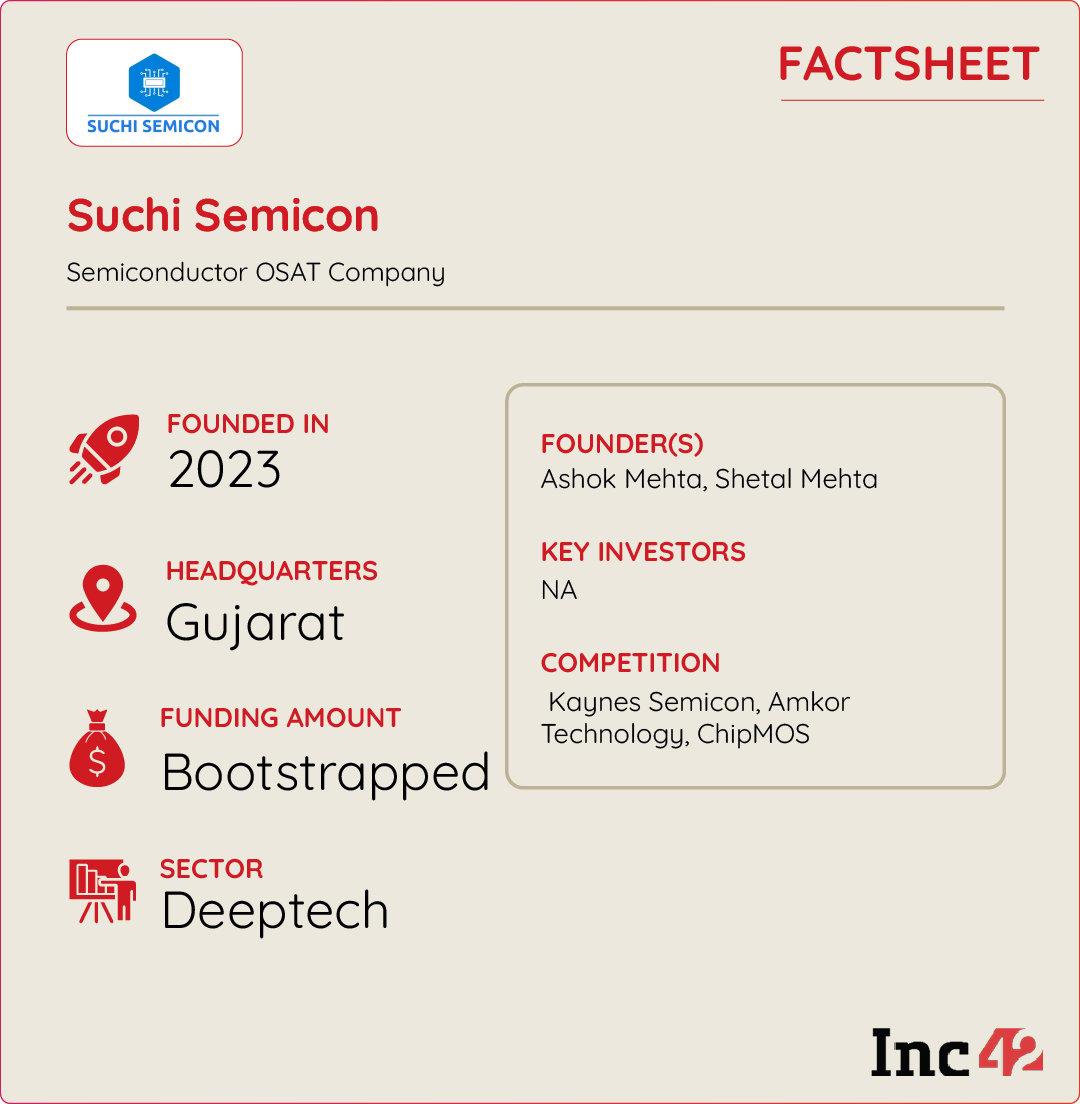

Can Suchi Semicon Power India’s Semiconductor Dreams?

Coming from a textile background, Ashok Mehta grew Suchi Industries into one of the biggest embroidery manufacturing companies in the country by 2022. But, it was a chance encounter with vendors in Malaysia, an outsourced semiconductor assembly and test (OSAT) hub, which changed the trajectory of Mehta’s life and business ambitions.

Along with his son Shetal Mehta, he pivoted his textile business to the uncharted semiconductor arena and founded Suchi Semicon in 2023. The startup operates as an OSAT, which is a third-party vendor providing assembly, packaging, and specialised testing of integrated circuits.

Suchi Semicon started building its factory in Surat in 2023 with an investment of INR 840 Cr. The plant, which opened in December last year, is slated to commence commercial production by March this year, once the delivery of equipment for the unit is completed.

With a capacity of producing 1.5 Lakh chips per day, Suchi Semicon plans to scale the production to 3 Mn chips a day in the next three years. It also plans to increase its workforce to 1,000 in this period and open another factory in the country under a joint venture with a Japanese company.

The post OYO’s FY26 Outlook, Darwinbox Bags $140 Mn & More appeared first on Inc42 Media.

https://ift.tt/TKegNOR

0 Comments