PW’s Prateek Maheshwari On $3.6 Bn IPO

In India’s edtech graveyard, Physics Wallah (PW) has defied all odds. The unicorn, led by a self-described socialist Alakh Pandey and capitalist Prateek Maheshwari, is all set to become the first edtech to go public and raise INR 3,480 Cr via its IPO. So, how did this unlikely duo crack the edtech puzzle?

The 95% Solution: While competitors burned billions chasing the top 5% of the market, PW zeroed in on the rest. By doubling down on affordability, scale and a strong offline push, the company has expanded to 45 Lakh paid learners and grown its revenue 4X to INR 3,000 Cr over the past five years.

An Issue Of Confidence: Unlike the recent IPOs of Groww and Lenskart — both of which were criticised for being too OFS-heavy, not one of the company’s investors is offloading even a single share. Why? Maheshwari believes investors see a lot of potential, arguing that the INR 31,500 Cr post-listing valuation is modest and leaves a lot of value for VCs.

Simultaneously, the founder duo still retain over 80% equity, enabling a blend of control and mission to focus on underserved markets and rapid expansion.

Challenges Of Scale: But the journey hasn’t been without its pitfalls. PW has been navigating high faculty attrition (40% in FY24), which the company attributes to removing incompetent faculty. And while YouTube fame was the launchpad, the company now plans to ramp offline centres from 170 to 400, boost average revenue per user and deepen market penetration in the coming years.

For now, the key question is: can it maintain its “socialist” soul of affordability while scaling its “capitalist” ambitions to satiate public market investors? Let’s find out…

From The Editor’s Desk

Decoding The Unicommerce Ethos

Decoding The Unicommerce Ethos

- Unicommerce’s three-tiered philosophy of patience, precision, and profit has set it apart in India’s chaotic ecommerce enablement sector, where most players still bleed red.

- While deep integrations and a diversified product suite helped the listed SaaS startup retain customers, the acquisition of Shipway helped Unicommerce strengthen scale, efficiency and fulfilment capabilities.

- Its next growth trajectory leans heavily on automation and AI, where Unicommerce’s playbook – data-driven decisioning and demand forecasting – positions the company to shape the next phase of ecommerce infrastructure.

upGrad Bids For BYJU’S

upGrad Bids For BYJU’S

- The Ronnie Screwvala-led edtech unicorn has submitted an expression of interest to acquire Think & Learn, the bankrupt parent of BYJU’S, signalling its ambitions to further scale in the fledgling Indian edtech space.

- With this, upGrad has joined the Manipal Group in the race to acquire all or select assets of BYJU’S, including Aakash and other units. A potential takeover could mark one of the biggest consolidations in the Indian edtech space.

- BYJU’S is undergoing insolvency after defaulting on its debts. The edtech startup has been plagued by mounting losses, heavy cash burn, mass layoffs, regulatory scrutiny, and a bevy of legal cases.

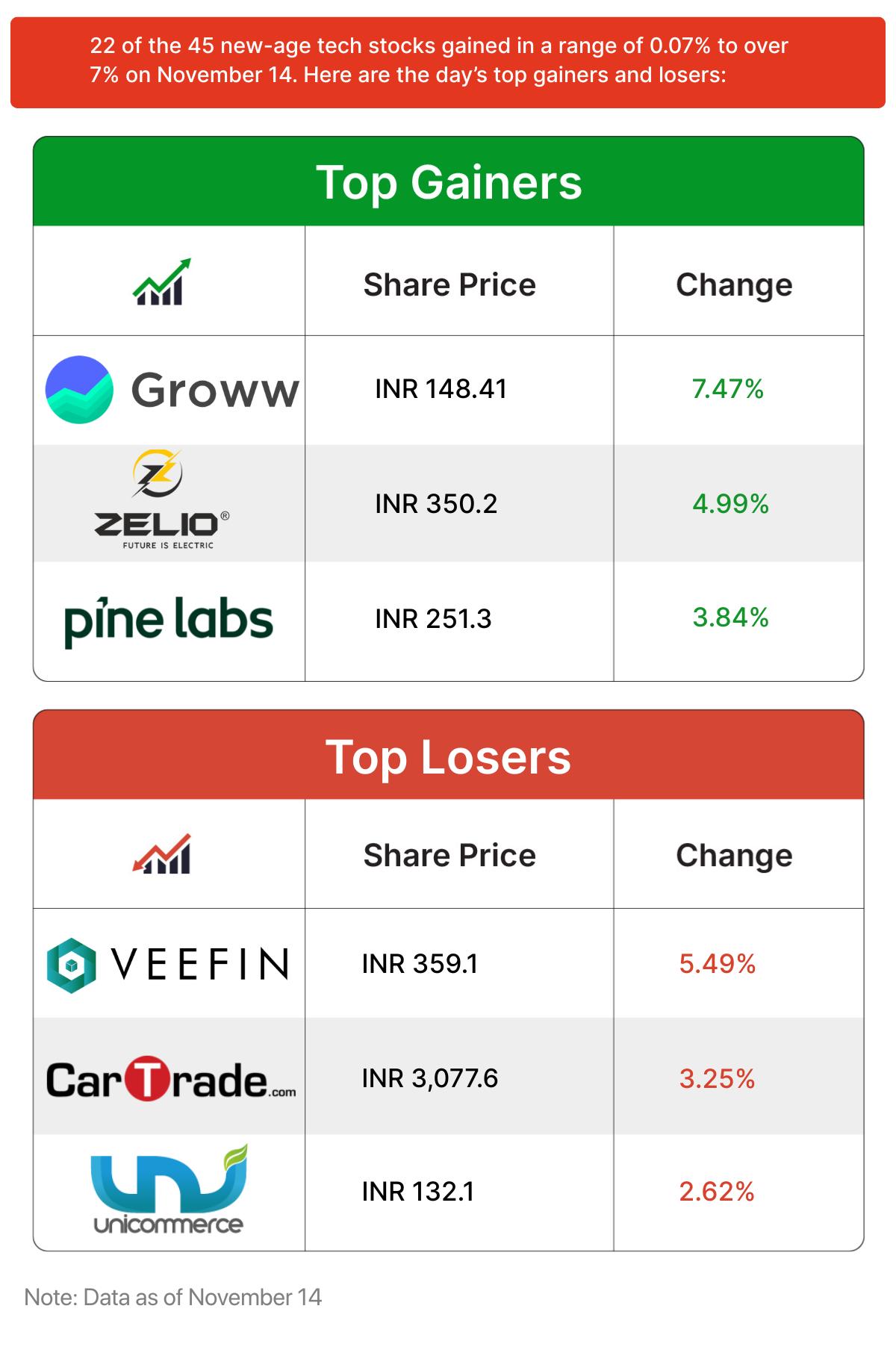

A Mixed Week For New-Age Tech Stocks

A Mixed Week For New-Age Tech Stocks

- Twenty of the 42 startup stocks under Inc42’s coverage ended the last week with gains, while the remaining 22 companies saw their share prices decline in a range of 0.07% to nearly 10%.

- The past week also saw three new startups debut on the exchanges, including Groww, Lenskart and Pine Labs. With the new additions, the total market capitalisation of new-age tech companies stood at $127.42 Bn at the end of the week.

- Overall, market sentiment partly improved on softer inflation and strong macroeconomic factors, even as FII outflows played the spoilsport.

DroneAcharya’s High-Fly Comeback

DroneAcharya’s High-Fly Comeback

- The drone manufacturer reported a net profit of INR 1.9 Cr in H1 FY26, up 26% YoY, after a steep loss of INR 15 Cr in H2 FY25. This came despite a 64% YoY dip in operating revenue to INR 9.6 Cr, but improving EBITDA and margins cushioned the degrowth.

- New defence orders, regulatory approvals for a remote pilot training course and advancements in long-range FPV and kamikaze drones signal recovery momentum, growing demand and institutional trust.

- The BSE SME-listed company was hampered throughout FY25 due to losses and operational setbacks. However, the post-Operation Sindoor push and investments in indigenous defence drones and training programmes helped DroneAcharya get on track.

Figma Bets Big on India

Figma Bets Big on India

- Figma has opened its first India office in Bengaluru as the country becomes its biggest market outside the US, driven by massive adoption and a fast-growing design community.

- India will serve as a go-to-market and community hub, powering Figma’s innovation, AI-led workflows, and deeper collaboration.

- With millions of Indian users, strong STEM talent, and rising design maturity, India is now central to Figma’s global roadmap and its vision of unifying design and research and development.

Inc42 Markets

Inc42 Startup Spotlight

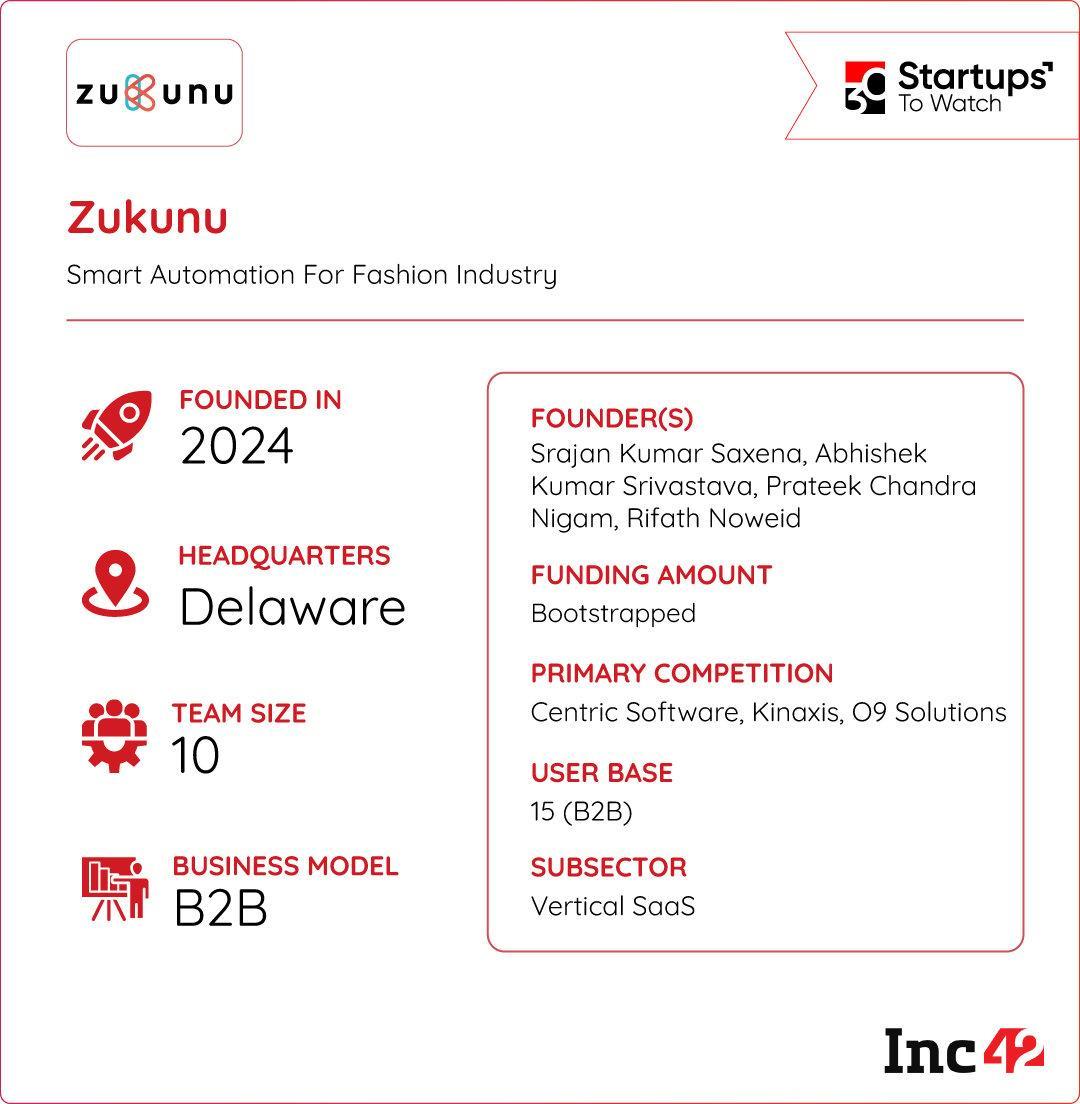

Can Zukunu Fix India’s Fashion Supply Chain?

Apparel manufacturing in India still runs on spreadsheets, messaging apps and outdated ERPs. This causes delays, miscommunication, and high wastage — problems that cost brands millions every year. Enter Zukunu, which aims to usher the apparel manufacturing ecosystem into the digital age.

AI For Apparel Operations: Founded in 2024, Zukunu is building an AI-led B2B SaaS platform for apparel supply chains. It connects brands and manufacturers in real time and automates key workflows. Its tools span vendor rating, order tracking, inventory turnover, consumption analysis, and lead time monitoring.

A Large, Untapped Market: The global fashion supply chain is estimated to cross the $1 Tn mark by 2030. Yet production hubs across India, Sri Lanka, and Bangladesh still rely on legacy systems. This gap has created a large opportunity for SaaS tools that can modernise the value chain between factories and brands.

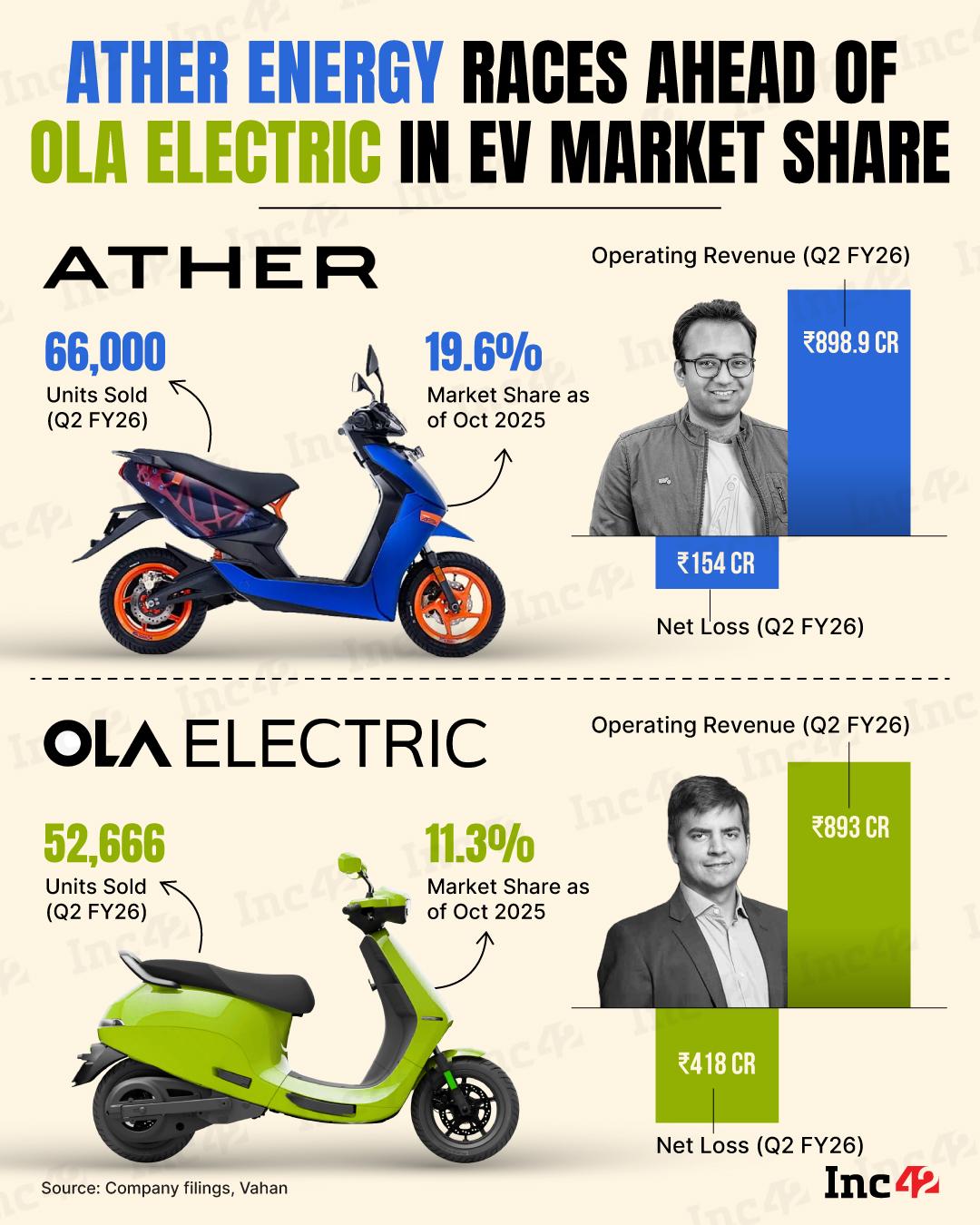

Infographic Of The Day

With 66,000 units sold in Q2 FY26 and a 19.6% market share as of October 2025, Ather Energy has taken a clear lead over Ola Electric in India’s EV scooter race. Here’s how Tarun Mehta-led EV maker is setting the pace.

The post PW’s Balancing Act, Unicommerce’s 3P Model & More appeared first on Inc42 Media.

https://ift.tt/F9v27w3

0 Comments