Ola Electric’s Shifting Focus

Ola Electric slammed the brakes on its chase for market share in Q2. As a result, the EV maker’s revenue and deliveries plummeted, but losses also shrank. This contrasting combo was no accident, but a deliberate pivot away from the aggressive discount culture in the EV space.

Steering To Profitability: The quarter saw Ola Electric focus more on its margins and product quality. The pain was evident in its vehicle deliveries, which fell sharply. The reward, however, was a healthier bottom line. The company’s core automotive segment turned EBITDA positive for the first time.

Here is the breakdown of Ola Electric’s Q2 FY26 numbers:

- Consolidated Net Loss: INR 418 Cr, down 15% YoY

- Operating Revenue: INR 690 Cr, down 43% YoY

- Vehicle Deliveries: 52,666 units, down 47% YoY

- Automotive Segment EBITDA: INR 2 Cr against an EBITDA loss of INR 162 Cr in Q2 FY25

The Cell Shakti: To offset declining vehicle sales, Ola Electric is aggressively pursuing new high-margin verticals. The EV maker is now looking to expand its cell capacity to 20 GWh from the 5 GWh estimate previously. Powering this is its recent foray into the commercial energy storage market (via Ola Shakti), which targets residential and commercial markets – a business it believes could be worth thousands of crores by FY27.

Big Bets, Bigger Questions: Ola Electric’s next act will be crucial – converting gross margin discipline and vertically integrated stack into sustained profit. But, with competition intensifying, incentives declining, and a tumbling top line, is the EV giant spreading itself too thin with multi-front expansion into cells and energy storage? While that is a story for another day, here is how Ola Electric fared in Q2.

From The Editor’s Desk

Eternal’s District Gropes In The Dark

- A year after an INR 2,048 Cr Paytm Insider acquisition, District’s spiralling losses and uneven growth have triggered investor scrutiny over the going-out vertical’s long-term visibility and the high capex drain.

- Despite this, Eternal remains bullish, citing growing active users and its long-term plan to make District the hub for dining, retail, and live events. Internally, too, there seems to be a focus on strategic cash burn to expand categories and footprint before monetising.

- Nevertheless, experts believe that District must curate IPs to drive recurring interest and focus on building a sharper brand identity. Otherwise, it risks becoming another super app chasing shallow engagement in a market long dominated by BookMyShow.

Paytm’s Next Frontier

- After maintaining profitability for two consecutive quarters, Paytm is now shifting its focus to bolster revenues. Its new strategy would be built on three growth levers – the relaunched BNPL business, the payments vertical and AI.

- Focussing on small-ticket size, Postpaid 2.0 will leverage Paytm’s network effects to turn users into active lending customers, building defensible stickiness. Alongside, its INR upcoming 2,250 Cr infusion into payments arm will scale offline merchant networks.

- Paytm is also turning AI from a cost-saving tool into a new monetisation vertical, and is testing merchant-facing digital assistants and analytics products to bring in more top line.

Smartworks Inches Closer To Profitability

- The coworking space provider managed to trim its Q2 FY26 net loss by 80% YoY to INR 3.1 Cr, aided by strong demand and improved cost discipline. Operating revenue rose 21% YoY to INR 424.8 Cr, while EBITDA improved 46% YoY to INR 69.6 Cr.

- Founded in 2016, Smartworks has built its identity on large-format enterprise workspaces. Its 9.1 Mn sq ft managed office portfolio serves 760 corporate clients, with overall occupancy at 81%.

- As Smartworks eyes sustained momentum through FY27-28 on the back of growing coworking space demand, margin improvement may face headwinds from rising expansion costs and competitive lease pricing.

Groww’s IPO Day 2

- The investment tech unicorn’s public issue saw robust retail demand, ending Day 2 with an oversubscription of 1.64X. Retail investors led the pack (5.02X), followed by NIIs (2.26X) and cautious QIBs (0.2X).

- Groww’s INR 6,600 Cr IPO comprises a fresh issue worth INR 1,060 Cr and an OFS component of up to 55.72 Cr shares. At the upper end of its INR 95-100 price band, the startup would be valued at INR 61,735 Cr.

- While Groww’s IPO has curried favour with investors for its diversified revenue stream and profitability, critics are wary about regulatory headwinds, OFS-heavy IPO and declining retail participation.

Manipal Group Bids For BYJU’S

- Ranjan Pai’s Manipal Education & Medical Group (MEMG) has submitted an expression of interest to the resolution professional of BYJU’S to bid for all assets of the troubled edtech startup.

- The move primarily targets the troubled edtech’s key asset – its 25% stake in Aakash. This bid will enable Pai to consolidate ownership, safeguard his stake in Aakash and formally distance the coaching chain from the legacy troubles of BYJU’S.

- BYJU’S is in the midst of insolvency proceedings due to failure to repay loans, while Aakash has been struggling to raise funds due to alleged interference from the RP of BYJU’S.

PB Fintech Acquires Fitterfly

- The insurtech giant’s healthtech arm, PB Health, has acquired Mumbai-based Fitterfly to strengthen its chronic disease management stack and expand its preventive care offerings.

- The acquisition also signals PB Fintech’s growing intent to diversify beyond insurance aggregation into healthtech services. The deal will also bring in Fitterfly’s customer base, IP and execution capabilities into the listed company’s fold.

- This follows PB Fintech foraying into healthtech earlier this year to build a 1,200-bed hospital ecosystem across Delhi NCR. In May, the new vertical raised over $218 Mn from General Catalyst and others.

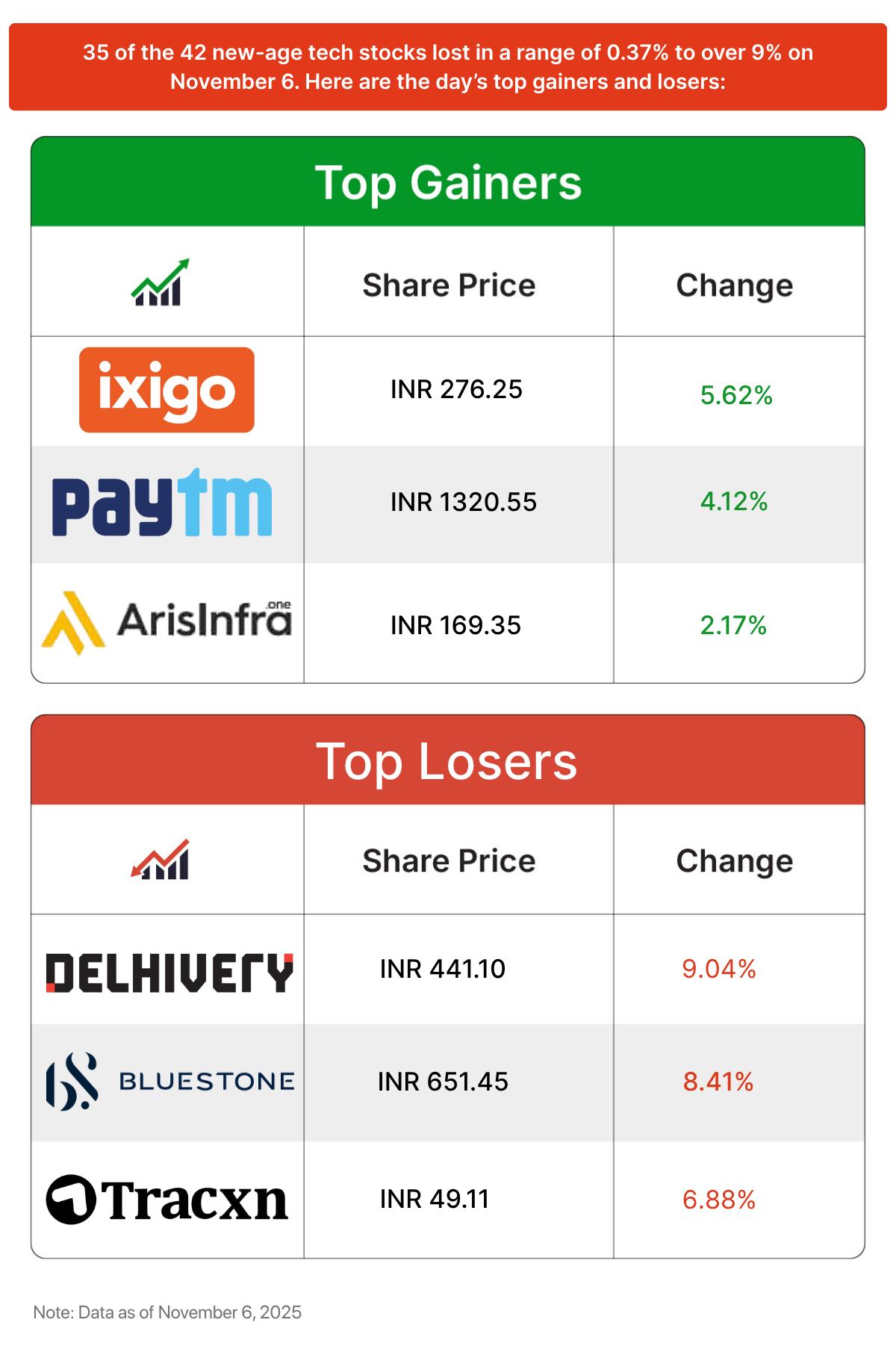

Inc42 Markets

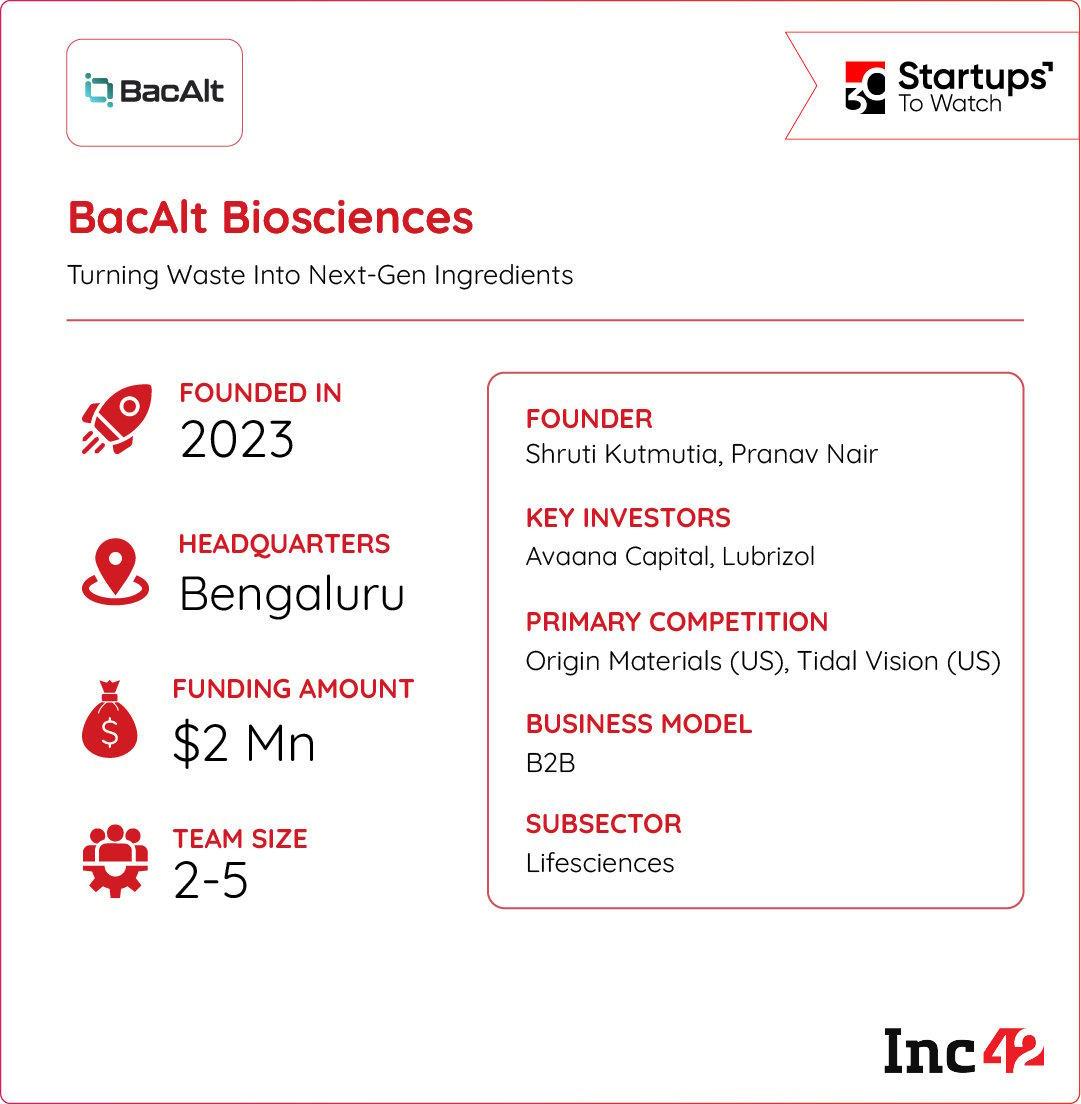

Inc42 Startup Spotlight

How BacAlt Is Turning Farm Waste Into Polymers?

Synthetic polymers are used in everything, from shampoos to packaging. Yet, their non-biodegradable nature and dependence on fossil fuels pose sustainability challenges. Bengaluru‑based startup, BacAlt Biosciences, believes the solution lies in nature, not a factory.

Turning Waste Into Gold: Founded in 2023, BacAlt’s proprietary non‑sterile fermentation process transforms post‑harvest agricultural residues into high‑performance bacterial polymers. These polymers act as natural thickeners, stabilisers, and moisture‑binding agents, which can substitute petrochemical‑derived materials in everyday products.

Bio‑Based Alternate: BacAlt is targeting industries that consume millions of tonnes of synthetic polymers annually — cosmetics, home care, agriculture, and pharmaceuticals. Its bio‑based polymers not only promise biodegradability but also deliver technical performance comparable to their synthetic counterparts.

Riding The Growing Demand: As the world moves towards clean-label products, BacAlt Biosciences is looking to ride the rising demand wave with its cleantech moat. It is looking to tap into India’s sustainable biopolymers market, which is projected to grow to $844.2 Mn by 2032.

Backed by its sustainability proposition, can BacAlt Biosciences help industries save energy and cut down on waste?

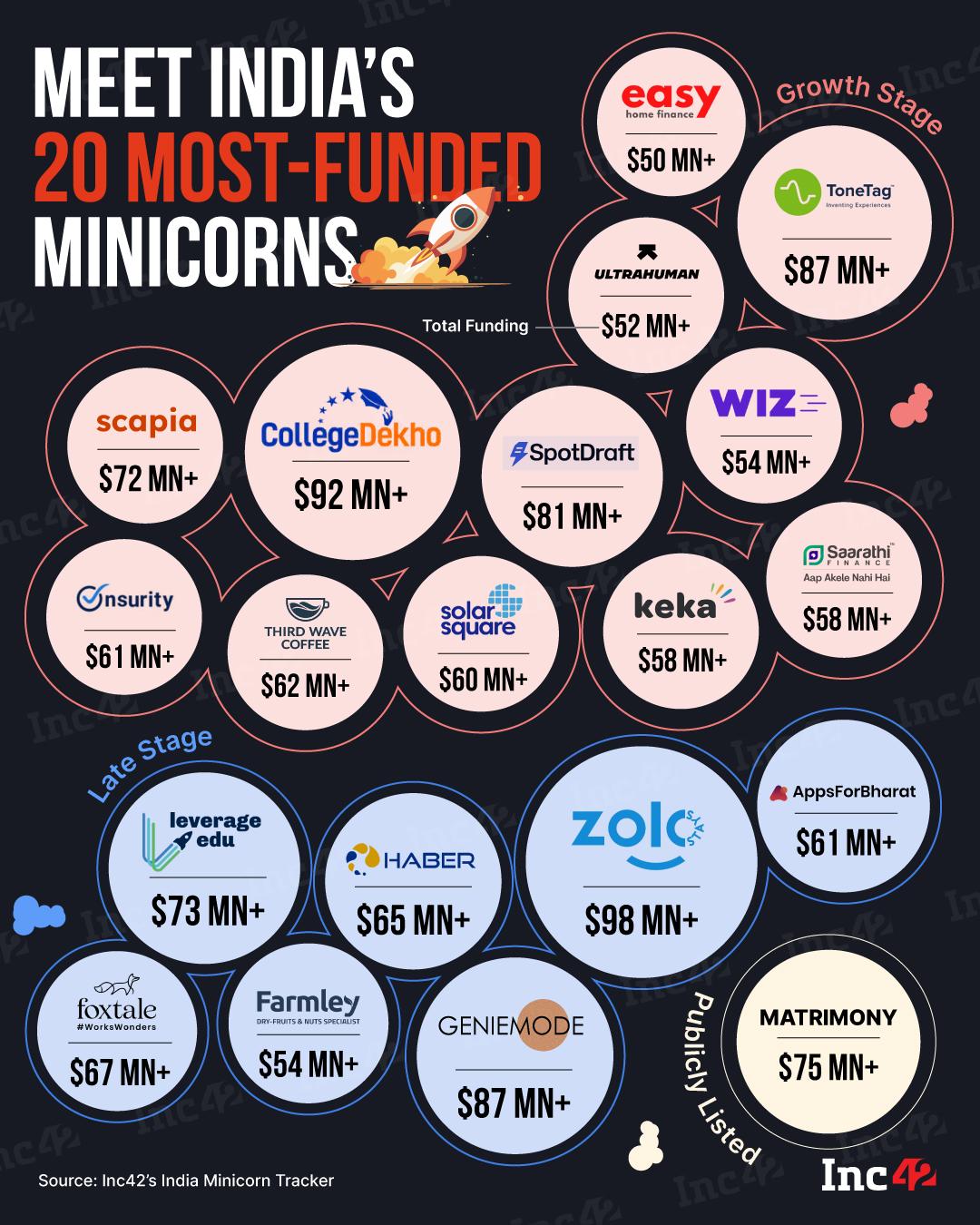

Infographic Of The Day

India’s startup story continues to evolve — and the next chapter belongs to the minicorns. With that said, here are India’s most-funded minicorns.

The post Ola Electric’s Loss Shrinks, District Groping In The Dark & More appeared first on Inc42 Media.

https://ift.tt/dwVv8zZ

0 Comments