Urban Company’s INR 854 Cr Anchor Boost

Urban Company’s IPO is all set to open today. Ahead of the public issue, the on-demand services unicorn raised INR 854 Cr from 59 anchor investors. So, who all backed the home service marketplace ahead of its public issue?

Breaking Down Anchor Allocation: The company allocated 8.29 Cr equity shares at INR 103 each, the upper end of its price band, to investors like Goldman Sachs, Nippon India, ICICI Prudential, among others. Of this, 3.06 Cr shares were allocated to six domestic mutual funds.

The Numbers Game: Urban Company’s INR 1,900 Cr IPO comprises a fresh issue of INR 472 Cr and an OFS of INR 1,428 Cr. It has set a price band of INR 98 to INR 103 per share for the issue, implying a post-issue valuation of INR 14,800 Cr at the upper end of the spectrum.

Tailwinds To Drive IPO Momentum: Overall, investor enthusiasm remains robust, evidenced by the grey market premium climbing to 35% yesterday. Several factors, like a strong brand recognition, leadership in organised home and beauty services, healthy FY25 revenues, and a well-diversified income stream, could work in favour of the company’s market debut.

Caution Ahead! Despite the optimism, Urban Company faces significant challenges, including intense competition from unorganised players, pricing pressures and the capex-heavy nature of its global expansion. Additionally, past controversies surrounding unfair working conditions for its gig workers and “forcing” its products on its technicians continue to cast shadows over its operational practices.

Nevertheless, with names like Steadview Capital, Florida Retirement System and Motilal Oswal, too, flocking to invest in the company, Urban Company seems all decked up to break the recent lacklustre startup IPO spree.

From The Editor’s Desk

Licious Shuts UnCrave: The D2C meat platform has quietly discontinued its plant-based meat brand. The startup pulled the plug on UnCrave to focus on achieving profitability ahead of its plans to get listed next year.

Tata 1mg’s User Retention Model: The epharmacy’s marketing stack is built on acquiring new users, keeping them engaged and ensuring they return. Going forward, 1mg is now reshaping its marketing engine by integrating AI and focussing on privacy.

Porter Eyes $110 Mn: The logistics unicorn is in advanced stages of raising an additional $100 Mn to $110 Mn in its extended Series F round. The logistics unicorn aims to raise funds at the same $1.2 Bn valuation it was assigned in May this year.

PW Founders Dump Stakes: As per the edtech giant’s updated DRHP, cofounders Alakh Pandey and Prateek Maheshwari together sold stakes worth INR 402 Cr ahead of its listing. PW plans to become India’s first listed edtech startup as it looks to raise INR 3,820 Cr via its IPO.

BHIM Pips Amazon Pay: The state-backed digital payments app surpassed the ecommerce giant’s fintech arm in the UPI race in August. While BHIM processed 10 Cr payments worth nearly INR 15,000 Cr, Amazon Pay clocked 9.8 Cr transactions totalling INR 10,800 Cr.

DevX’s INR 63 Cr Anchor Round: The coworking space provider allotted over 1 Cr equity shares to 11 anchor investors at INR 61 apiece. The coworking major plans to raise INR 143.3 Cr via its public listing and has set a price band of INR 53-61.

Minute Media Acquires VideoVerse: The US-based digital media publisher has acquired the Binny Bansal-backed SaaS startup for an undisclosed amount. Angel investors are said to have bagged 10–20X returns, while institutional backers clocked a 60–70% IRR from the deal.

India’s $20 Bn Semiconductor Push: The Centre is mulling an INR 1.7 Lakh Cr outlay for India Semiconductor Mission 2.0. The second phase of the project will focus on building India’s first display fab, incentivising chip design patents and building a robust supply chain.

Inc42 Startup Spotlight

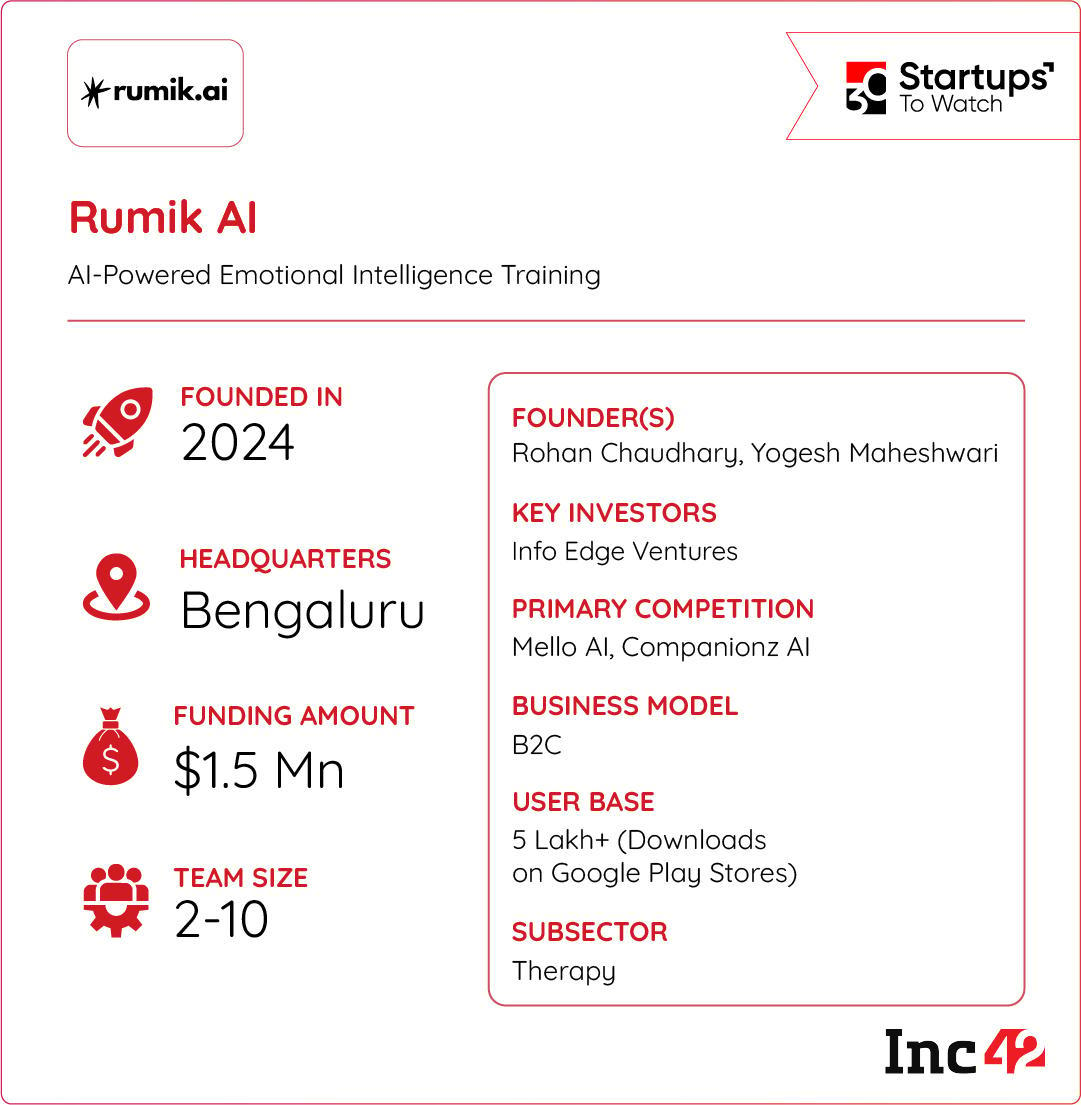

Can Rumik’s AI Bot Solve India’s Loneliness Crisis?

In today’s hyperconnected world, loneliness is a growing problem. Traditional support systems often fall short, leaving a significant gap for those seeking personal connection and emotional support. Looking to solve this problem is Rumik AI.

Emotional AI Companions: Founded in 2024, the Info Edge-backed startup is building emotionally intelligent AI companions that can connect with people on a personal level and combat social isolation. Launched just four months ago, its flagship conversational AI bot, Ira, can understand intent and infer emotions.

The bot can also converse fluently in Hindi, English, Bangla and Marathi.

A Strong Start: Catering to its customers via its own app and WhatsApp, Rumik claims to have already clocked 5 Lakh downloads on Google Play Store. It earns revenue through in-app purchases and also sells its subscriptions to enterprises.

Operating in a space where human touch always has an advantage, can Rumik AI solve India’s loneliness crisis?

The post Urban Company IPO Goes LIVE, Licious Shuts UnCrave & More appeared first on Inc42 Media.

https://ift.tt/X1JqrHG

0 Comments