Can PhysicsWallah Break The Edtech Jinx?

Days ago, PhysicsWallah submitted its updated DRHP with SEBI for an INR 3,280 Cr public listing. Amid the dilapidated state of Indian edtech, the listing could be a breath of fresh air. But is PW’s touted IPO more smoke than fire?

Sound Fundamentals? PhysicsWallah’s FY25 financials present a compelling turnaround – losses dropped 78% YoY to INR 243.3 Cr while operating revenue zoomed 49% YoY to INR 2,886.6 Cr. Yet, a deeper analysis reveals that FY24 losses, adjusted for one-time expenses, stood at INR 376 Cr, reducing the actual improvement to 35% rather than the headline 78%.

Expansion Pains: There are also troubling signs in PW’s expansion strategy. Revenue from Kota, its inaugural offline centre, plunged 40% YoY due to declining enrolments in FY25. Meanwhile, aggressive acquisitions – including OnlyIAS, Utkarsh Classes, and Xylem – carry combined losses of INR 100 Cr, straining cash flows while adding integration complexity and inherited liabilities.

Cautious Market Sentiment: Grey market enthusiasm also remains muted. PW’s unlisted shares are trading at INR 145-150, down from June’s INR 165. Compounding concerns, the company is planning INR 548 Cr capex on offline centres over three years, potentially weighing on profitability.

The Founder Factor: Despite challenges, early investors are demonstrating unusual faith in the company by altogether avoiding the OFS component. This confidence stems from Alakh Pandey’s cult-like following among students. PW’s strategic pivot to hybrid learning and aggressive offline expansion also gives it the diversification edge while positioning it as an established test-prep player.

As PW eyes an INR 35,000 Cr+ IPO valuation, the entire sector is watching to see if the company can shatter the Indian edtech jinx with a blockbuster debut.

From The Editor’s Desk

Zupee Axes 170 Jobs: The gaming startup has culled 30% of its workforce, following the ban on online real money games in India. With this, Zupee has become the latest gaming startup, after Games24x7, PokerBaazi, A23 and MPL, to fire employees in recent weeks.

Purple Style Labs Gears Up For IPO: The house of brands has received board’s approval to raise up to INR 750 Cr via a fresh issue of shares during its IPO. In regulatory filings, the company said that it may also raise up to INR 140 Cr in its pre-IPO placement round.

PayU India Reins In FY25 Losses: The Prosus-owned fintech major managed to slash its net loss by 42% to INR 248.1 Cr in FY25 from INR 429.5 Cr in FY24. Meanwhile, operating revenue surged 23% YoY to INR 5,563 Cr during the fiscal year under review.

Fast Tracking Desh Wapsi: A year after allowing startups to reverse flip without seeking approval from the NCLT, the corporate affairs ministry has now broadened the scope of the exemptions to enable more companies to redomicile to India.

Urban Company IPO Day 2: The hyperlocal services major’s public issue was oversubscribed 9X on the second day, receiving bids for 96.1 Cr shares as against 10.6 Cr shares on offer. While the NII portion was subscribed 18.2X, the retail quota saw 17.6X subscription.

Early Diwali For PhonePe Staff: The fintech giant has initiated an ESOP buyback scheme worth up to INR 800 Cr. The move is expected to benefit 1,000 out of the company’s 12,000 employees. This comes as PhonePe is looking to raise up to $1.5 Bn via its IPO.

DevX IPO Day 2: The coworking space provider’s IPO was oversubscribed 16X at the end of the second day of bidding. Leading the pack, retail investors placed bids for 13.64 Cr shares against 23 Lakh shares on offer.

FistCry Ups Stakes In GlobalBees: The omnichannel kidswear brand has completed its INR 146 Cr investment in its rollup ecommerce subsidiary by pumping INR 73 Cr in the second tranche. The listed startup has now increased its stake in the roll-up brand to 51.51%.

Inc42 Startup Spotlight

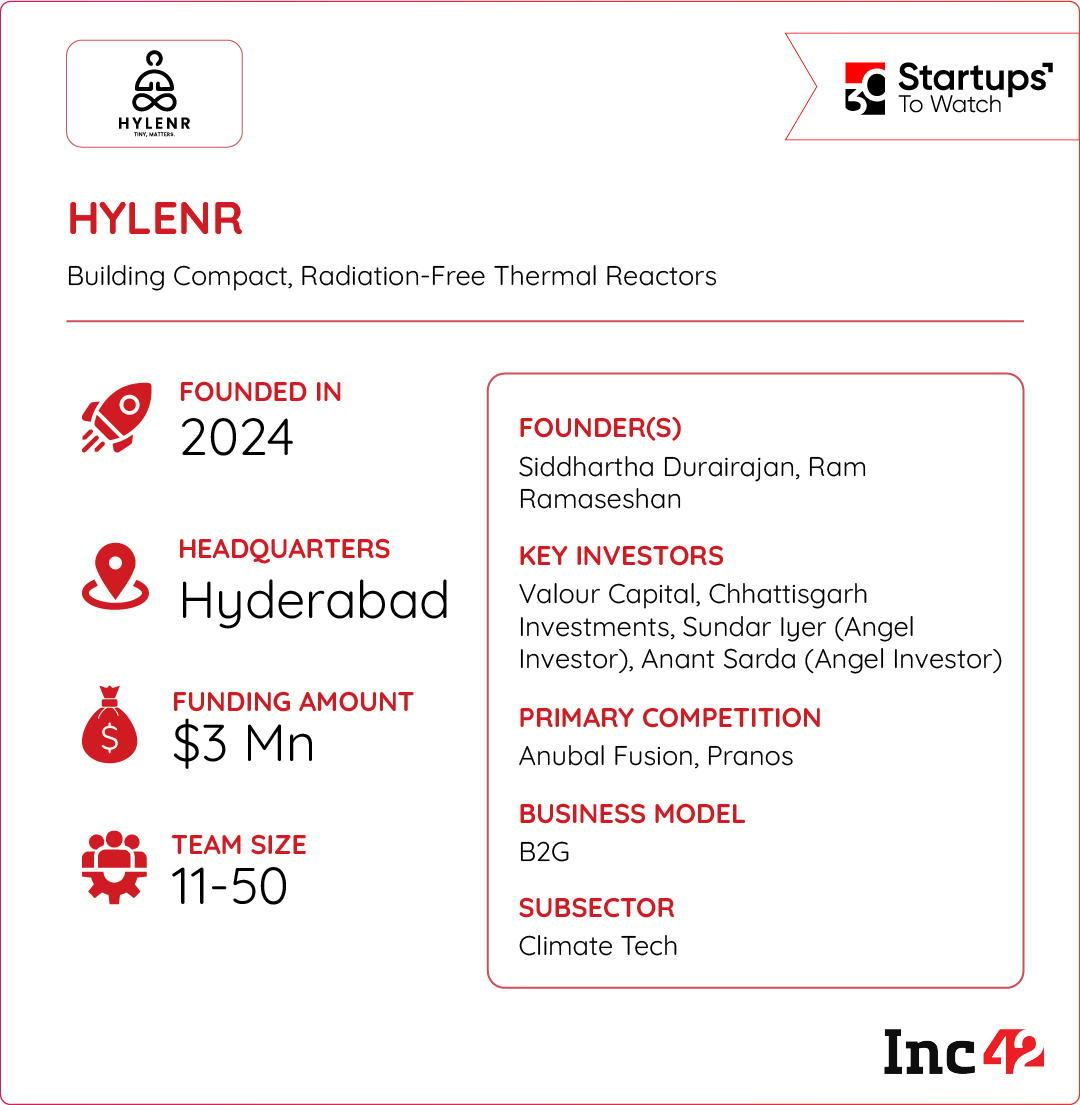

Building Radiation-Free Thermal Reactors

Nuclear power offers a big efficiency advantage over renewable energy sources. However, traditional nuclear reactors carry significant baggage – radiation hazards, radioactive waste disposal challenges and long development cycles. Trying to solve this is HYLENR.

HYNLR’s Nuclear Stack: Founded in 2024, HNLENR is building radiation-free thermal energy reactors that can generate power without the risks of radioactive waste or failures. The startup’s reactors are built on Low Energy Nuclear Reaction (LENR) principles, enabling fusion of chemical reactions at room temperature rather than the extreme conditions required by conventional nuclear reactors.

The Many Use Cases: The startup’s reactors offer unprecedented versatility, capable of powering applications ranging from space exploration missions to large-scale industrial operations.

Currently, the startup is developing pilot projects in collaboration with the Indian government and private enterprises, positioning itself at the intersection of innovation and practical implementation.

With its innovative radiation-free nuclear reactors, can HYLENR put India at the forefront of next-generation nuclear energy?

The post Can PW Redeem Indian Edtech, Zupee Axes 170 Jobs & More appeared first on Inc42 Media.

https://ift.tt/cdCSUOW

0 Comments